Checking the state of your credit score can be a daunting yet ultimately positive task. Logging on to a banking app, or directly via one of the three credit agencies (Experian, TransUnion, Equifax), and seeing the steady improvement in your credit score is a great feeling — as you work towards financial health and stability.

On the other hand, there may be times when you carry out this routine task and are instead shocked to see a decline in your credit score — perhaps for no apparent reason. This event causes concern to many every day, as can be seen from the volume of online searches from people wondering what went wrong.

The fact is there are many reasons for your credit score to fall — from the everyday and easily fixed, to the potentially catastrophic. Below are the top reasons for a credit score drop — as well as remedial actions to follow.

Why Did My Credit Score Drop? Top Twelve Reasons

The following are the most common twelve reasons for a decline in your credit score:

- You missed or made a late payment to your credit card provider

- You finished paying off a loan (thereby reducing your credit data)

- You closed a credit card (as above)

- You made an unusually large purchase with your credit card

- You applied for a new credit card (credit checks lower your score)

- You have a high balance on your card (which is deemed risky)

- You co-signed a loan or financial application (you are jointly liable)

- There is a mistake in your credit report data

- Someone unauthorized used your credit card

- Your credit limit was reduced by your service provider

- A large financial event took place (bankruptcy, foreclosure, defaulting)

- You have become the victim of identity theft

Credit Cards and Identity Theft

Identity theft is far more common than people think, with $43 billion lost in 2022 and 1 in 6 Americans affected. A large, unexplained drop in your credit score can be one of the first warning signs of your identity having been compromised. If fraudsters acquire your identity credentials, they will be able to open up credit accounts in your name and carry out large transactions, whilst ignoring any and all bills as they come due.

You’ll want to check this by carefully evaluating your credit reports, and looking for unknown addresses, accounts, and transactions. If something has gone wrong, you should place a credit freeze on your accounts. You should also report the case to the FTC at IdentityTheft.gov. For more guidance from Trend Micro, head over here, and here.

Protecting Your Identity and Personal Info

Compromised personal data can have serious consequences, including identity theft, financial fraud, and job losses. The best thing you can do is a) have reliable cybersecurity protection, and b) ensure you will find out ASAP in the event of being affected. We would encourage readers to head over to our new FREE ID Protection platform, which has been designed to meet these challenges.

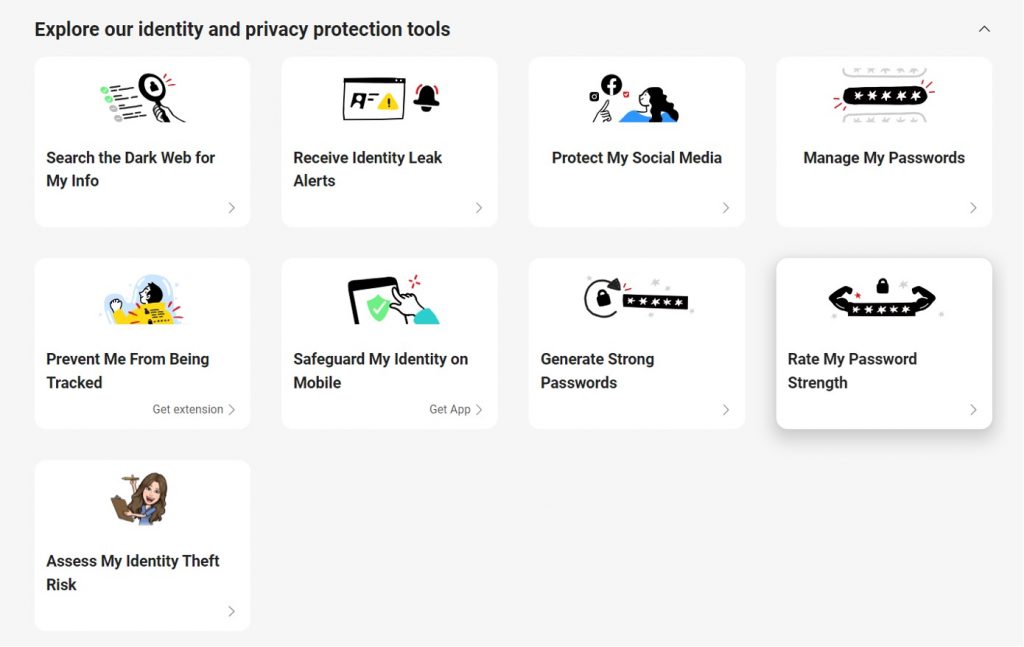

With ID Protection, you can:

- Check to see if your data (email, number, password, credit card) has been exposed in a leak, or is up for grabs on the dark web;

- Secure your social media accounts with our Social Media Account Monitoring tool, with which you’ll receive a personalized report;

- Create the strongest tough-to-hack password suggestions from our advanced AI (they’ll be safely stored in your Vault);

- Enjoy a safer browsing experience, as Trend Micro checks websites and prevents trackers.

- Receive comprehensive remediation and insurance services, with 24/7 support.

Offering both free and paid services, ID Protection will ensure you have the best safeguards in place, with 24/7 support available to you through one of the world’s leading cybersecurity companies. Trend Micro is trusted by 8 of the top 10 Fortune 500 Companies — and we’ll have your back, too.

Credit Score Top Five Health Tips

Follow these best practices to improve your credit score — and keep it healthy in the first place:

- Remember to pay your bills on time.

- Minimize debt and practice responsible spending habits.

- Check your credit reports regularly.

- Don’t apply for unnecessary credit cards.

- Protect your identity with Trend Micro ID Protection

As always, we hope this article has been an interesting and/or useful read. If so, please do SHARE it with family and friends to help keep the online community secure and informed — and consider leaving a like or comment below.

1 Comments

- By isabelle klar | December 4, 2023