In today’s hyper-competitive environment, parents are always on the lookout for something to give their child an edge as they grow up into young adults. A notable example of this is the desire to instill in your child good financial acumen and to help them build a healthy credit score. One way this can be done is to add your child as an authorized user of your credit card. Let’s take a moment to look at the rules, features, and pros and cons.

How Old Does Your Child Need to Be to Use a Credit Card?

To get a credit card in your own name you need to be 18 and older, for obvious reasons. To be added as an authorized user on a parent’s existing credit card, however, the process is much simpler and comes with more relaxed age requirements. Given these are private companies, they each have their own approach, meaning there are different rules: U.S. Bank, for example, has no minimum age, while American Express has a minimum age of 13. The list below provides a roundup of the big players and the minimum age for each.

- Bank of America — No min.

- Capital One — No min.

- Citi — No min.

- Chase — No min.

- U.S. Bank — No min.

- Wells Fargo — No min.

- American Express — 13

- Barclays — 13

- Discover — 15

How to Add and Remove Your Child from Your Credit Card

Adding your child as an authorized user to your credit card is generally an easy process, because although the child will have spending power, you the adult will remain solely responsible for the account. For most banks, it will be as simple as going online (or however you manage your account), and putting in a request to add a secondary, authorized user. Required personal information will include:

- Full name

- Date of birth

- Citizenship

- Email address

- Phone number

- Social security number

- Mailing address

When the time comes to remove your child as a user, it should be even easier — just submit a request to the bank.

Should Your Child Be an Authorized User of Your Credit Card?

Adding your child as an authorized user may be easy, but it’s not a step to take lightly — you are after all allowing them to spend money they do not technically have. Parents should ask themselves the following six questions as a precursor to any decision taken:

- Is this necessary?

- Do you have reliable protection ready to safeguard security and privacy? (See bottom!)

- Does your child know what credit cards really are and how they work?

- Is your child mature enough for this responsibility?

- What is the state of your credit?

- What rules should you agree on and can your child stick to them?

Aside from the above, consider the following pros and cons:

The good:

- You will improve your child’s credit score as authorized users build credit too

- You’ll teach your child responsibility and encourage independence

- You will earn extra rewards from their additional spending, too

- Your child will have access to emergency funds

- Your child will receive travel perks and purchase protection

The risks:

- You, and you alone, will be liable for their spending

- Your child may exceed a spending limit, causing extra fees

- More users means more security and privacy risks

- Shared usage may lead to arguments

- It may be hard to keep track of who is spending what

- Some banks charge fees for additional users

- If your credit score goes down, your child will be affected, too

In summary, there are an equal amount of reasons for and against when it comes to adding your child as an authorized user to your credit card. Ultimately, it’s up to parents to decide if it’s necessary and if your child is ready.

Protecting Your Identity and Personal Info

Adding a child as an authorized user to a parent’s credit card is increasingly popular. Nonetheless, the prospect of increased security and privacy risks is no doubt an anxiety: a stolen or compromised credit card can have serious consequences, including identity theft, financial fraud, and job losses.

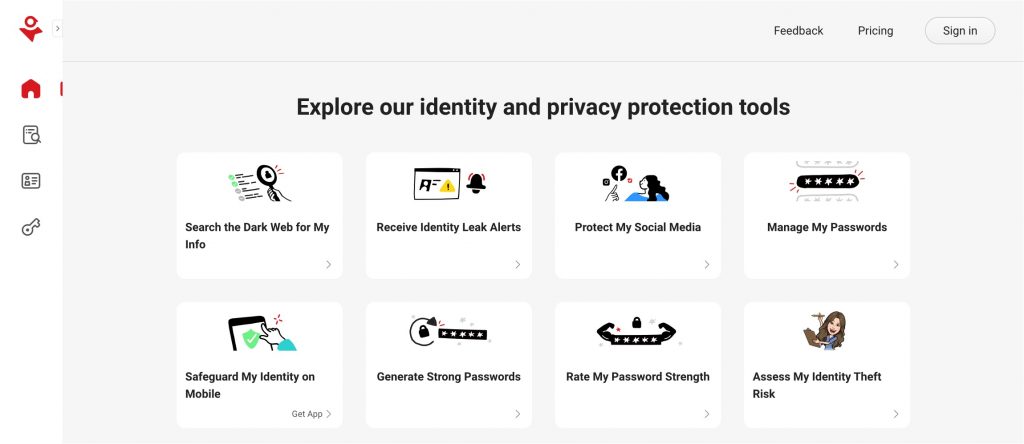

With that in mind, we would encourage readers to head over to our new FREE ID Protection platform, which has been designed to meet these challenges.

With ID Protection, you can:

- Check to see if your data (email, number, password, credit card) has been exposed in a leak, or is up for grabs on the dark web;

- Secure your social media accounts with our Social Media Account Monitoring tool, with which you’ll receive a personalized report;

- Receive the strongest tough-to-hack password suggestions from our advanced AI (they’ll be safely stored in your Vault);

- Enjoy a safer browsing experience, as Trend Micro checks websites and prevents trackers.

All this for free — why not give it a go today? As always, we hope this article has been an interesting and/or useful read. If so, please do SHARE it with family and friends to help keep the online community secure and informed — and consider leaving a like or comment below.