American Express customers are on high alert after the financial giant disclosed that credit card information was compromised in a third-party data breach. Sensitive information about American Express cardholders, such as account numbers, names, and card expiration dates, may have been compromised by the breach that happened at a merchant processor.

Origin of the Breach

American Express clarified that the breach did not originate from its own systems but rather from a service provider engaged by multiple merchants. The breach notification, filed with the state of Massachusetts, underscored the precautionary nature of the alert, emphasizing that American Express’s internal systems remained secure.

Response and Notification

In response to inquiries about the breach, American Express refrained from disclosing specific details regarding the merchant processor involved, the scope of affected customers, or the timeline of the incident. However, the company assured that regulatory authorities have been notified, and impacted customers are being alerted accordingly.

Concerns and Reassurance

The breach raises concerns about the potential misuse of compromised credit card data, as hackers could exploit stolen information for fraudulent transactions. American Express moved swiftly to reassure customers that they would not be held liable for unauthorized charges resulting from the breach.

Recommendations for Affected Customers

As part of its response efforts, American Express advised affected customers to closely monitor their account statements for suspicious activity over the coming months. Additionally, the company recommended enabling instant notifications through its mobile app to receive real-time alerts regarding potential fraud attempts or unauthorized transactions.

Given the risk of continued exposure, affected cardholders are encouraged to consider requesting a replacement card number to mitigate further potential risks. This proactive measure aligns with industry best practices to prevent the exploitation of stolen credit card data on illicit online marketplaces.

In addition, affected cardholders are encouraged to keep an eye out for these general signs of identity theft:

- Look for charges/bills you don’t recognize. Additionally, if you stop receiving a regular bill, it could mean that somebody has changed your billing address.

- Watch out for your mail going missing or new, unexpected mail.

- Regularly review your credit reports for suspicious activity. You are entitled to one free credit report from the three national credit reporting agencies (Equifax, Experian, and TransUnion). Click here to learn how to get a free credit report (it’s easy!).

- Be wary of unusual tax documents. Identity thieves love to file fraudulent tax returns in people’s names and steal their tax refunds. If you receive any correspondence about a tax return that you haven’t filed, it could be a sign that this has happened to you.

- Be cautious of unexpected SMS/email verification codes because it could mean that someone is trying to access your account.

Protecting Your Identity and Personal Info

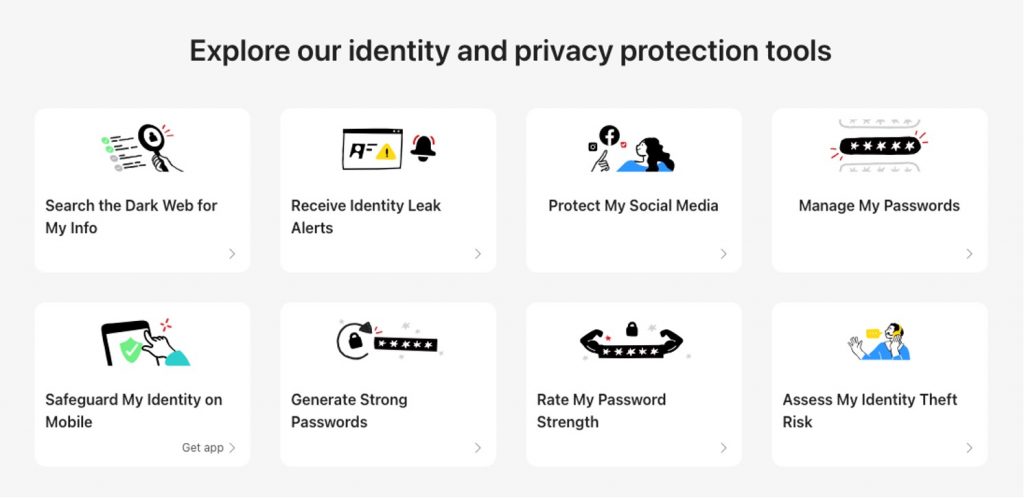

Compromised personal data can have serious consequences, including identity theft, financial fraud, and job losses. The best thing you can do is a) have reliable cybersecurity protection, and b) ensure you will find out ASAP in the event of being affected. We would encourage readers to head over to our new ID Protection platform, which has been designed to meet these challenges.

With ID Protection , you can:

- Check to see if your data (email, phone number, password, credit card) has been exposed in a leak, or is up for grabs on the dark web;

- Secure your social media accounts with our Social Media Account Monitoring tool, with which you’ll receive a personalized report;

- Create the strongest tough-to-hack password suggestions from our advanced AI (they’ll be safely stored in your Vault);

- Enjoy a safer browsing experience, as Trend Micro checks websites and prevents trackers.

- Receive comprehensive remediation and insurance services, with 24/7 support.

Offering both free and paid services, ID Protection will ensure you have the best safeguards in place, with 24/7 support available to you through one of the world’s leading cybersecurity companies. Trend Micro is trusted by 8 of the top 10 Fortune 500 companies — and we’ll have your back, too.

Why not give it a go today? As always, we hope this article has been an interesting and/or useful read. If so, please SHARE it with family and friends to help keep the online community secure and informed — and consider leaving a like or comment below.