The thought of having their identity stolen is a big concern for most Americans. The fear is unsurprising, given that it’s one of the most serious criminal threats — and is only growing. Last year alone, $43 billion was lost to identity theft and fraud, with 40 million Americans affected. There are ways however, to keep on top of the threat, ways to check if your identity has been stolen — and warning signs to look out for.

How to Check if Someone Is Using Your Identity

Be sure to follow these three best practices to stay ahead of identity thieves:

- Stay on top of bills: Know what you owe and when it’s due. If you stop receiving a bill, and it wasn’t you that made this change, this could be a red flag that someone has changed your billing address. Similarly, if you receive new bills, which you didn’t sign up for, an identity thieve may be using your personally identifiable information (PII).

- Bank statements: You should regularly review your bank account statements. If you see a transaction that you don’t recognize, it could be a sign that your identity has been stolen.

- Credit report: You should also check your credit regularly. To do so you’ll need to request a report from the three credit-reporting bureaus (Equifax, Experian, and TransUnion). Your credit score isn’t enough to ascertain if you’re identity has been stolen; you’ll need the full report to check for unknown accounts and transactions, and to look for any false information. For a guide on how to do this, head over here!

Further top tips:

- Check your health insurance records and tax return information

- Make sure you always have access to sensitive online accounts

- Watch out for spam emails, texts, and mail

- Check for physical mail and stolen trash

- Always know where your ID, credit cards, and other sensitive documents are kept

- Check your “mySocial Security” account for signs of fraud

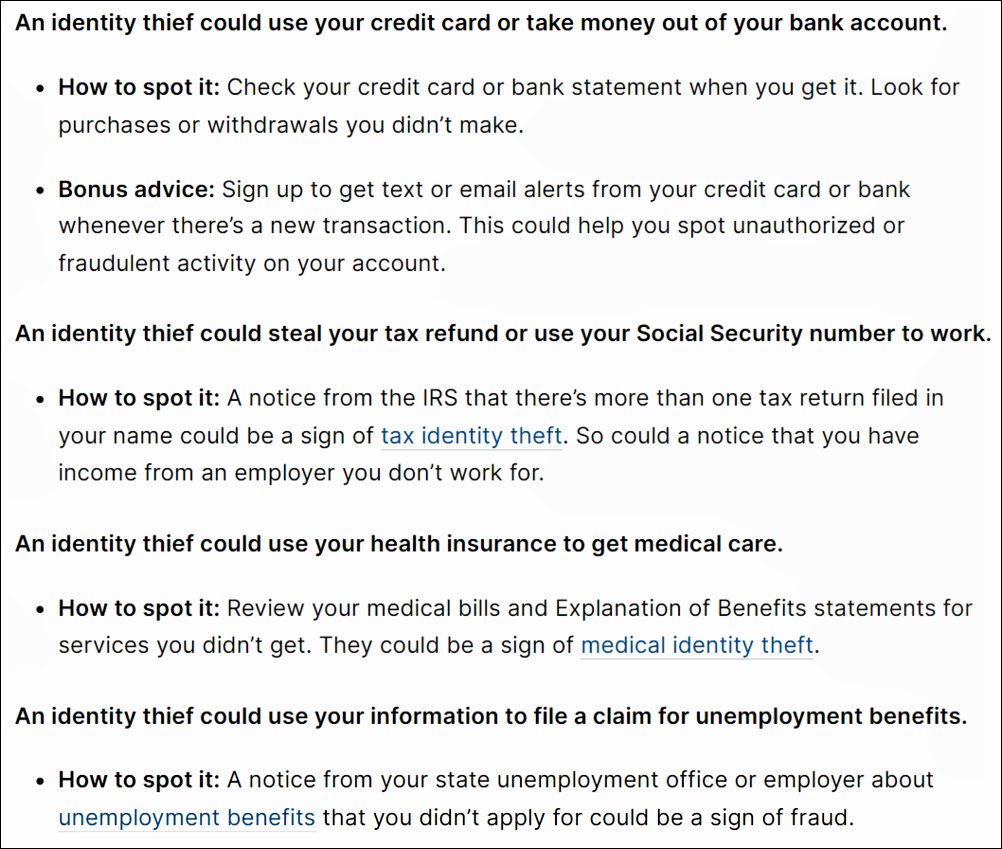

The Federal Trade Commission (FTC) have also put together a handy guide to different identity theft scenarios:

Seven Warning Signs of Identity Theft

- A tax return is filed under your name without your authorization.

- Mail is addressed to your home but to another person.

- Debt collectors get in touch regarding accounts you don’t recognize.

- Your information was leaked in a data breach.

- You are billed for medical services you never used.

- You spot a new account in your name that you didn’t open.

- The IRS get in touch to inform you that you’re Social Security card is being used fraudulently.

Protecting Your Identity and Personal Info

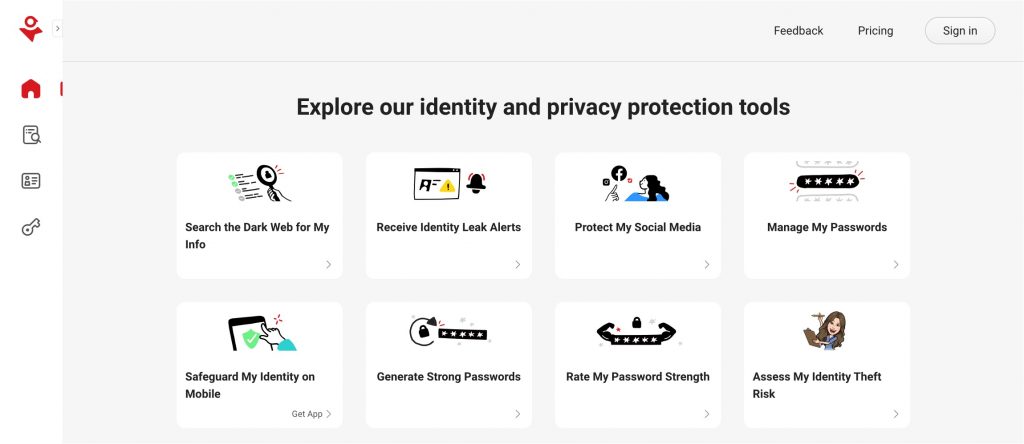

Identity theft can have serious consequences. The best thing you can do is a) have reliable cybersecurity protection, and b) ensure you will find out ASAP in the event of being affected. We would encourage readers to head over to our new ID Protection platform, which has been designed to meet these challenges.

Trend Micro ID Protection gives you all the tools you need to improve your online privacy and shield against identity theft, fraud, and unauthorized access to your online accounts. Its comprehensive range of features includes personal identity monitoring, social media monitoring, a secure password manager, and a privacy-enhancing browser extension.

With ID Protection you can…

- Receive alerts if your personal info gets leaked.

- Stop sites from collecting privacy-compromising data.

- Safeguard your social media accounts against hackers.

- Protect against online threats, such as phishing scams.

- Create, store, and manage strong, tough-to-hack passwords.

What’s even better, is that you can enjoy a 100% unrestricted, 30-day free trial of ID Protection, so you can take advantage of all its awesome features and start securing your identity and privacy today! Click the button below to get started!

If you’ve found this article an interesting and/or helpful read, please SHARE it with friends and family to help keep the online community secure and protected. Also, please consider clicking the LIKE button below and leaving a comment to tell us what you think

5 Comments

- By Joel B. Rickert | November 13, 2023

- By GaryEloyLueras | November 12, 2023

- By Elizabeth J Acosta | July 1, 2023

- By Kenneth Niel Stansel Sr. | July 1, 2023

- By Benjamin Innocent | June 20, 2023