Last Updated on Nov 13, 2023

One of the most common ways that scammers target a would-be victim’s finances is by using stolen credentials to open new accounts or take out loans and credit cards in the victim’s name. In 2021, 42 million Americans were victims of identity fraud, with losses reaching $52 billion. At the same time, over 4,000 data breaches were publicly disclosed in 2021, with 22 billion personal records exposed. In the same year, the FTC alone received almost 700,000 reports of fraudulent bank account, loan, and credit card applications.

How Does a Credit Freeze Work?

A credit freeze (also known as a security freeze), is a great way to protect your credit, identity, and finances from fraudsters. Once enabled, it blocks access to your credit reports, preventing scammers from opening fraudulent accounts or making fraudulent applications. A credit freeze has this preventative effect because when someone attempts to carry out a credit-related act, the relevant authority must first check your credit information before making a decision: with that information blocked, the process cannot proceed. A credit freeze also comes with specific protections backed up by US government law.

Credit Freeze: Pros and Cons

The Pros

- Freezing your credit greatly reduces the chances of someone creating a fraudulent account in your name.

- A freeze won’t affect your credit score or your existing credit accounts.

- It will give you peace of mind knowing that your credit report is safe.

- Credit freezes are now free to do with each of the three credit bureaus.

- Credit freezes last indefinitely, so you won’t need to worry about them expiring.

- A credit freeze will stop you from impulsively applying for a new credit card because lifting a freeze will take between one hour and three business days.

The Cons

- A credit freeze still won’t offer 100% protection against identity theft and fraud. For example, your credit cards, bank accounts, and other PII, could still be targeted.

- You’ll need to contact each credit bureau individually to enact a credit freeze (likewise to unfreeze). There are also other, smaller, bureaus that may still allow access to fraudsters — for example, National Consumer Telecom & Utilities Exchange (NCTUE) and Innovis.

- You should receive (or create) a unique PIN number for freezing and unfreezing your credit. While this offers another layer of protection, it’s nonetheless another credential you’ll need to remember and keep secure.

- A credit freeze will mean having to plan ahead (due to the delay mentioned above) if you intend to open a credit line (credit card, mortgage, loan) because you’ll need to request a temporary unfreezing first.

How to Freeze Your Credit?

As stated above, you’ll need to contact each of the three main credit bureaus: Experian, Equifax, and TransUnion. Thankfully, it’s a relatively painless and quick process — although you’ll need to provide information such as full name, address, DOB, and Social Security number.

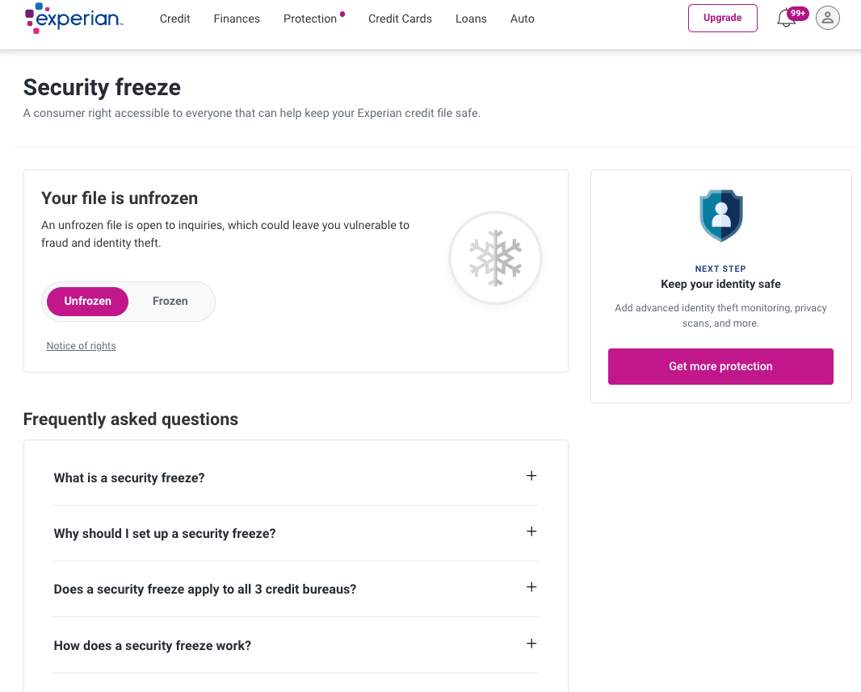

Experian Security Freeze

In the case of Experian, you can:

- Do so via your online account on the website.

- Phone 888-397-3742 and request a freeze.

- Mail a request with (required info) to:

“Experian Security Freeze

P.O. Box 9554

Allen, TX 75013″.

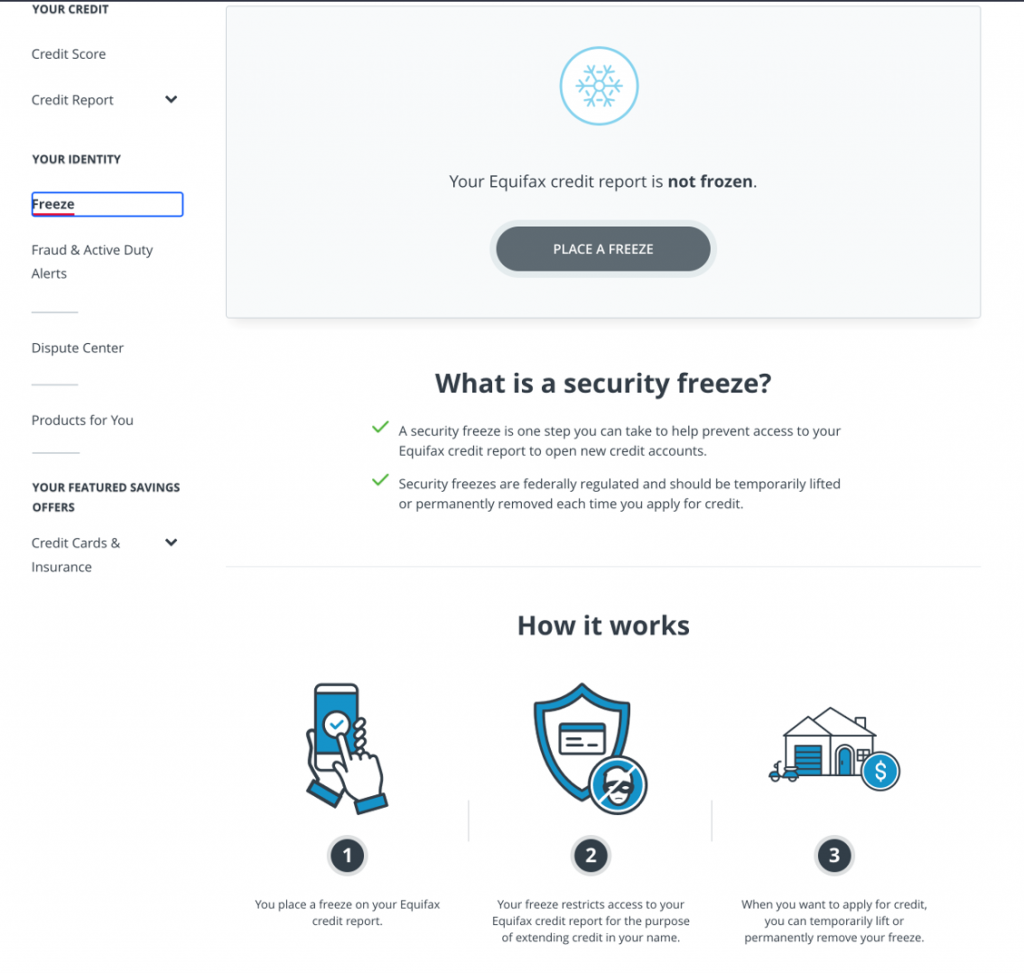

Equifax Security Freeze

In the case of Equifax, you can:

- Do so via your online account on the website.

- Phone 800-349-9960 and request a freeze.

- Mail a request with (required info) to:

“Equifax Information Services LLC

P.O. Box 105788

Atlanta, GA 30348-5788″.

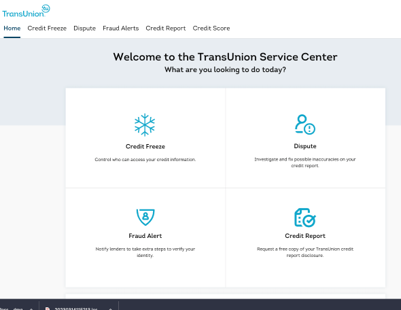

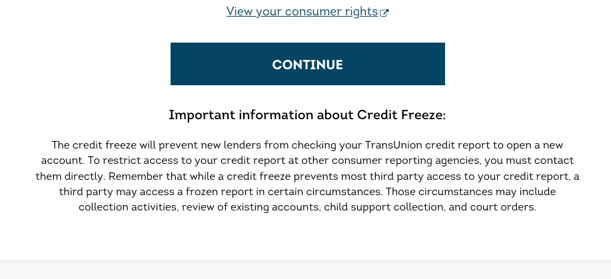

TransUnion Credit Freeze

In the case of TransUnion, you can:

- Do so via your online account on the website.

- Phone 888-909-8872 and request a freeze.

- Mail a request with (required info) to:

“TransUnion

P.O. Box 160

Woodlyn, PA 19094″.

How to Unfreeze Credit

If you decide to unfreeze, or “thaw”, your credit for some reason, just get in contact with the bureaus using the details above. You’ll be able to unfreeze via phone and mail IF you pass security questions, but it may be easier to do so online — furthermore, if you do so online, it will take effect within the hour, compared to three days via the phone/mail route.

Top Tip: For a single credit application, you’ll only need to unfreeze your credit with the relevant bureaus: just ask the creditor which credit bureau it will use to check your credit, and unfreeze that one — saving you time and hassle.

Credit Freeze Alternatives

Fraud Alerts

Anyone who suspects fraudulent activity can place a fraud alert on their credit report for FREE. This will make it more difficult for someone to open a credit account in your name because a business must then first verify your identity. When you place a fraud alert on your credit report, you will also get a free copy of your credit report from each of the three credit bureaus. A fraud alert lasts one year, after which you can decide to renew it.

You can contact any one of the three credit bureaus to enact a fraud alert. The bureau you decide to contact will then tell the other two to place a fraud alert on their end as well.

Credit Monitoring

It’s a good idea to monitor your credit in order to learn about problems as they arise ASAP. Several companies, including the three credit bureaus, offer credit monitoring services — most are free while others are paid. You can also monitor your credit yourself by ordering free credit reports once a year. To find out how to do this, head over to our previous article, How to Get Your Free Credit Report.

Credit Lock vs Credit Freeze

People are a little confused by the difference between locks and freezes — and the truth is it is overly complex. In short, a credit lock is a private service that the three credit bureaus provide to their customers. It is said to be easier and quicker to activate and deactivate than credit freezes. At the end of the day, however, credit locks essentially do the same thing as credit freezes. The main difference is that you have to pay (with Experian) or enroll in another service agreement (with Equifax and TransUnion). Finally, as a private service, credit locks do not come with the same government protections.

Protecting Your Identity and Personal Information

A credit freeze can be a great way to add another layer of defense to your identity and finances, but it won’t afford 100% protection against identity theft and fraud. For example, your credit cards, bank accounts, and other PII, could still be targeted.

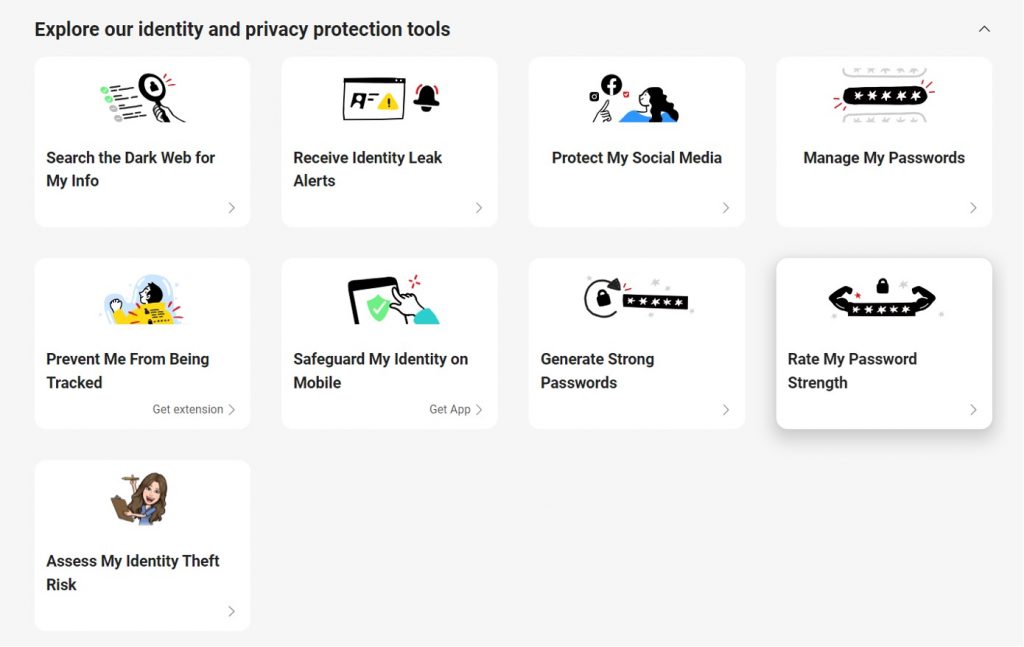

Try our newly launched service, Trend Micro ID Protection, which gives you all the tools you need to improve your online privacy and shield against identity theft, fraud, and unauthorized access to your online accounts! Its comprehensive range of features includes personal identity monitoring, social media monitoring, a secure password manager, and a privacy-enhancing browser extension.

With ID Protection, you can:

- Check to see if your data (email, number, password, credit card) has been exposed in a leak, or is up for grabs on the dark web;

- Secure your social media accounts with our Social Media Account Monitoring tool, with which you’ll receive a personalized report;

- Receive the strongest tough-to-hack password suggestions from our advanced AI (they’ll be safely stored in your Vault);

- Enjoy a safer browsing experience, as Trend Micro checks websites and prevents trackers.

What’s even better is that you can enjoy a 100% unrestricted, 30-day free trial of ID Protection‘s paid versions so that you can take advantage of all its awesome features and start securing your identity and privacy today! Click the button below to get started!

If you’ve found this article an interesting and/or helpful read, please SHARE it with friends and family to help keep the online community secure and protected. Also, please consider clicking the LIKE button below and leaving a comment to tell us what you think!

1 Comments

- By Tom L. | April 22, 2023