In today’s digital age, accessing important financial documents has become increasingly convenient. The Internal Revenue Service (IRS) offers taxpayers a user-friendly online platform to obtain their tax transcripts swiftly and securely. The IRS’s “Get Transcript” service serves as a valuable resource for individuals seeking to retrieve their tax information hassle-free.

What is an IRS Tax Transcript?

Before delving into the process of obtaining your tax transcript online, it’s essential to understand what a tax transcript entails. Essentially, a tax transcript is a summary of your tax return information. It includes various types of transcripts, such as:

- Tax return transcript: This transcript provides most line items from your tax return as filed, including accompanying forms and schedules. It does not reflect any changes you made after the return was filed.

- Tax account transcript: This transcript shows basic data such as return type, marital status, adjusted gross income, taxable income, and any adjustments made to your tax return. It does not show changes made after filing.

- Record of account transcript: This transcript combines the tax return and tax account transcripts into one complete transcript. It shows most line items from your tax return and any adjustments made after filing.

How to Obtain Your IRS Tax Transcript Online

Accessing your IRS tax transcript online is a straightforward process. Follow these simple steps to retrieve your transcript:

- Visit the IRS website: Navigate to the IRS website at www.irs.gov.

- Select “Get Your Tax Record”: Under the “Tools” section, select “Get Your Tax Record.” Alternatively, you can directly visit the transcript page by clicking here.

- Choose your preferred method: The IRS offers two methods for obtaining your tax transcript: online or by mail. For instant access, select the “Get Transcript Online” option.

- Create an account or log in: If you’re a first-time user, you’ll need to create an account. Returning users can log in using their existing credentials.

- Verify your identity: To ensure security, the IRS will ask you to verify your identity. You may need to provide personal information such as your Social Security number, date of birth, and filing status.

- Select the type of transcript: Choose the type of transcript you need based on your specific requirements: tax return transcript, tax account transcript, or record of account transcript.

- View and download your transcript: Once your identity is verified, you can view, print, or download your tax transcript directly from the IRS website.

Benefits of Obtaining Your Tax Transcript Online

Obtaining your IRS tax transcript online offers numerous benefits, such as:

- Convenience: Access your tax information anytime, anywhere, without the need to visit an IRS office or wait for documents to arrive by mail.

- Instant access: With the online platform, you can retrieve your tax transcript instantly, saving time and effort.

- Enhanced security: The IRS employs stringent security measures to protect your personal and financial information, ensuring confidentiality and privacy.

- Cost-free: The “Get Transcript” service is free of charge, allowing taxpayers to obtain their tax transcripts at no additional cost.

- Accuracy: Online transcripts are generated directly from the IRS database, minimizing the risk of errors or discrepancies.

Key Security Tips for Obtaining Your Tax Transcript Online

- Use a secure connection: Always access the IRS website and other sensitive online platforms through secure and trusted connections.

- Verify website authenticity: Double-check the URL to ensure you’re on the official IRS website (www.irs.gov) before entering any sensitive information.

- Create a strong password: When creating an account or logging in to the IRS website, use a strong, unique password that combines letters, numbers, and special characters.

- Enable two-factor authentication (2FA): Enable two-factor authentication for an extra layer of security on your account.

- Beware of phishing attempts: Be cautious of unsolicited emails, text messages, or phone calls claiming to be from the IRS or other financial institutions. The IRS will not initiate contact via email, text, or social media to request personal or financial information.

- Securely dispose of documents: Safely store or securely dispose of any printed tax transcripts or related documents containing sensitive information. Shred or destroy documents before discarding them to prevent identity theft or fraud.

For more tips to stay safe this tax season, please visit this article.

Whether you need to verify income for a loan application, reconcile discrepancies, or simply keep track of your financial records, obtaining your IRS tax transcript online offers a convenient and reliable solution. But it’s important to remember to prioritize security by safeguarding your login credentials, using a strong password, and enabling two-factor authentication.

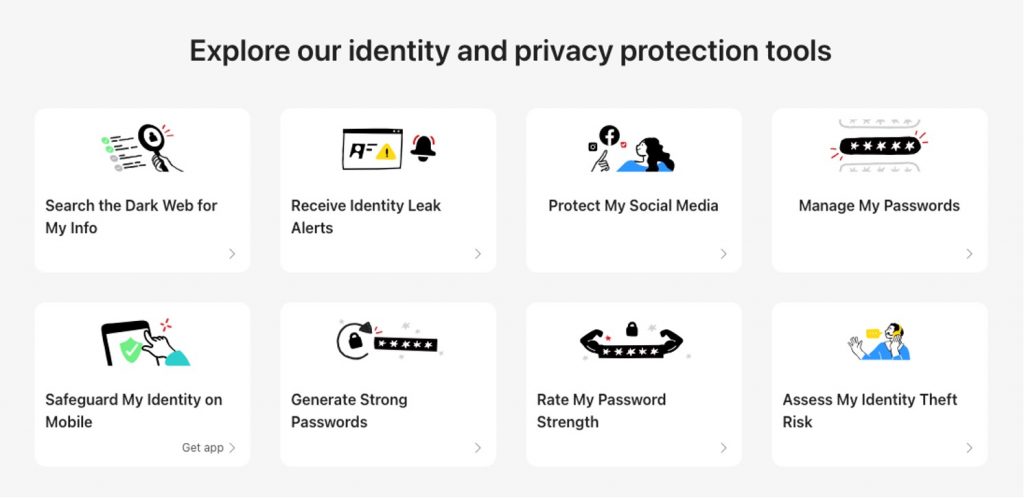

Also, consider using an ID Protection tool to protect your personal information:

With ID Protection, you can:

- Check to see if your data (email, phone number, password, credit card) has been exposed in a leak, or is up for grabs on the dark web;

- Secure your social media accounts with our Social Media Account Monitoring tool, with which you’ll receive a personalized report;

- Create the strongest tough-to-hack password suggestions from our advanced AI (they’ll be safely stored in your Vault);

- Enjoy a safer browsing experience, as Trend Micro checks websites and prevents trackers.

- Receive comprehensive remediation and insurance services, with 24/7 support.

Offering both free and paid services, ID Protection will ensure you have the best safeguards in place, with 24/7 support available to you through one of the world’s leading cybersecurity companies. Trend Micro is trusted by 8 of the top 10 Fortune 500 companies — and we’ll have your back, too.

If you’ve found this article an interesting and/or helpful read, please SHARE it with friends and family to help keep the online community secure and protected. Also, please consider leaving a comment or LIKE below.