Last Updated on March 13, 2024

Have you ever received an email from the Internal Revenue Service (IRS) claiming you can get a tax refund? Or, has someone who claimed to be from the IRS ever called you, telling you that you owe them taxes and you must pay up immediately? Be careful as tax season is upon us—and so are tax scams!

Facts About Tax Scams

The average loss per tax scam is over $4952 per victim. More than 14,700 taxpayers have lost more than $72.8 million since 2013 due to tax scams, with more than 2.4 million Americans targeted by hoaxers impersonating IRS officials. (April-to-September 2018 Semiannual Report to Congress, Treasury Inspector General for Tax Administration)!

4 Common Tax Scams

Tax scams come in many forms, but the bottom lines are similar. Scammers pretend to be IRS agents, other governmental officials, tax preparers, or charitable organizations. They try to lure you into paying money, submitting personal information, or even downloading malware or ransomware. Here are some common tax scams you should be cautious of:

1. IRS Text Message/Email Scams

Scammers send spoofed text messages or emails from the IRS about tax refunds, tax transcripts, electronic tax return reminders, or other tax-related issues. They claim that you must click on a link to claim your tax refund, or they prompt you to open an attachment to get more information.

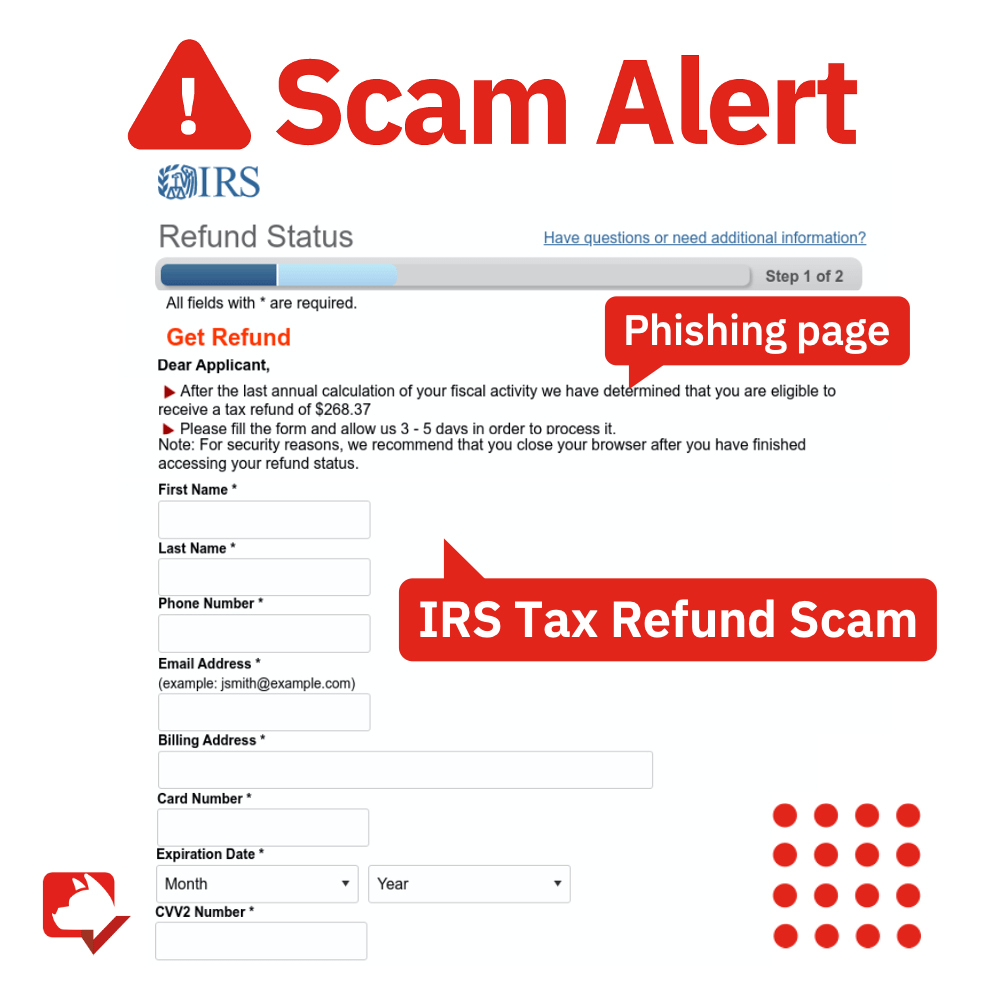

The link is a phishing link, which leads to a fake IRS website. It asks you to enter your login credentials and even banking details such as credit card numbers and CVC codes. The data you punch in will end up in scammers’ hands. Here’s an example:

In a worst-case scenario, malware or ransomware will start to download as soon as you click on the link or open the attached file.

Ransomware can first steal your identity and financial data through keystroke capture. Then it will lock files on your computer until you pay the ransomware fee. Even then, there is no guarantee you can retrieve your data.

2. IRS Robocalls and Phone Call Scams

Scammers pretend to be from the IRS Tax Payer Advocate Service office and reach out to you through phone calls or robocalls. They claim that there is a problem with your tax filing, or that you owe taxes and must pay up or change the settings in your IRS account. Then, they ask you to provide personal information such as Social Security number, Individual Taxpayer Identification Number (ITIN), or Identity Protection PIN (IP PIN).

Why do scammers want your sensitive information? For identity theft. They can get access to your bank account or create one in your name. Or, they will file a bogus tax return on your behalf and deposit the so-called refund in your account. They either divert refunds to their own bank accounts, or they pose as an IRS employee and reach out to you again, saying there was an error, and you must return the amount. They threaten that penalties will ensue unless you pay with gift cards or wire money to them.

3. Fake Charities

Besides the IRS, scammers pose as charities during a crisis, with some posing as those working on behalf of the IRS to help victims of casualty loss claims to get tax refunds.

Scammers will reach out to you in different ways: emails, phone calls, text messages, or even in person. They claim to be from charitable organizations and try their best to persuade you to donate money.

Read more about charity scams here.

4. Ghost Tax Preparers

Many people choose to hire a tax preparer to handle complex tax filing procedures, but you should be careful of “ghost tax preparers!” Dishonest “ghost preparers” can commit tax fraud by claiming fake tax credits and may charge fees based on the percentage of an inflated refund, among other dangers.

Red Flags of Tax Scams

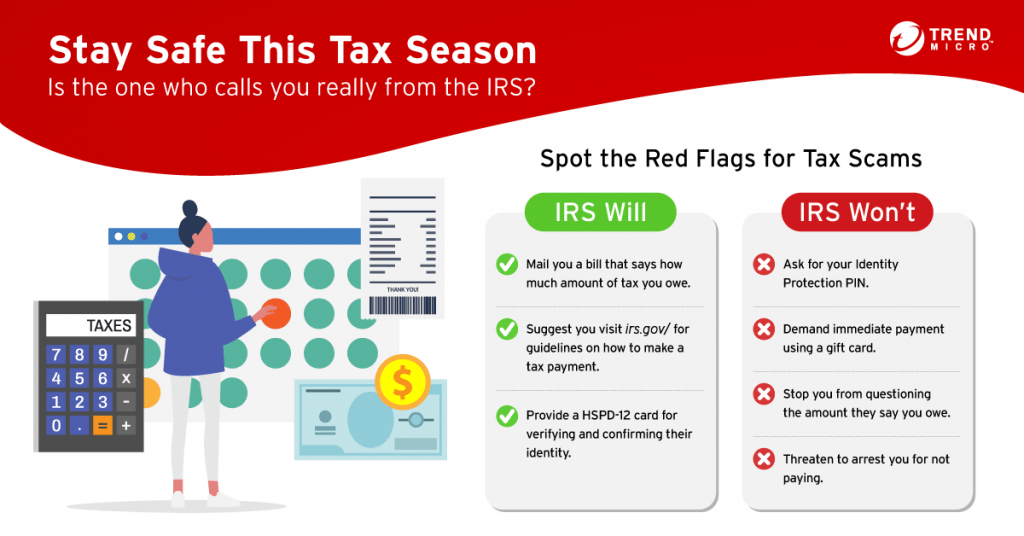

Please note that the IRS will NEVER:

- Call you without having first attempted to notify you by mail.

- Ask you to provide sensitive information such as Identity Protection PIN.

- Demand immediate payment using a specific payment method such as a prepaid card, gift card, or wire transfer.

- Stop you from questioning or appealing the amount they say you owe and ignore your rights as a taxpayer.

- Avoid showing their pocket commission and HSPD-12 card.

- Threaten to bring in law-enforcement like local police or immigration officers to have you arrested for not paying.

Stay one step ahead of identity theft for FREE with Trend Micro

Trend Micro ID Protection is a completely free tool that can tell you if your valuable data (email address, phone number, passwords, and social media accounts) have been leaked online. Additionally, we just added a brand-new feature: Social Media Account Monitoring (which is also 100% free!). After setting it up, we’ll make sure you’re immediately alerted if any strange activity — such as suspicious links posted to your feed or changes made to your bio — occurs on your accounts.

More Tips to Protect Yourself from Tax Scams:

Here is a list of Dos and Don’ts to avoid tax scams:

- Double-check the sender’s mobile number/email address.

- Don’t click on links or attachments from unknown resources.

- Contact the IRS officials directly for help.

- Protect your tax filing with Identity Protection PIN (IP PIN).

- Choose professional tax preparers with an IRS Preparer Tax Identification Number (PTIN). Check a tax preparer’s credentials on the IRS web page here.

- Don’t reveal your login credentials and other personal information to others.

- Install anti-malware to block phishing emails and websites and prevent malware downloads. Maximum Security and Trend Micro Mobile Security (for iOS / Android) help protect your devices against malicious and fake apps, ransomware, unsafe WiFi networks, dangerous websites, and unwanted access to your devices.

- Last, if you suspect a tax scam like an unsolicited email claiming to be from the IRS or an IRS-related function, please report to phishing@irs.gov.

Stay safe this tax season! If you think this article is helpful, please SHARE to protect your family and friends.