Last Updated on January 25, 2025

The tax season this year will start from January 27, 2025. Are you ready to file your taxes? If you ever receive an email or text that claims to be from the IRS, please watch out and check carefully: is it legitimate? In this article, we’ve compiled six IRS tax scams to beware of in 2025, along with some tips to stay safe this tax season. Read on to learn more.

Tax-related Identity Theft

Tax-related identity theft is a very serious problem. According to the IRS, 2.4 million tax returns were flagged for potential identity theft, and the fraudulent refunds totaled $13.8 billion as of May 2023. Besides, US consumers have already lost nearly $2.7 billion to imposter scams in 2023 alone. But how does tax-related identity theft happen?

Well, impersonating the IRS and under various pretenses, scammers try their best to trick you into revealing your personal information, such as your home address, date of birth, and Individual Tax ID Number (ITIN), with which they can file a bogus tax return on your behalf and deposit the refund into THEIR account. Be careful! Below are some examples:

Top 6 IRS Tax Scams 2025

Although it’s not an exhaustive list, when scammers reach out to you while impersonating the IRS, here’s what they may say:

- You have to confirm personal details to receive a tax refund.

- You qualify for the Economic Impact Payments.

- You can reduce taxes via their Offer in Compromise (OIC) program.

- You are eligible for their tax assistance program.

- There are issues with your IRS online account.

- You owe taxes and must complete payment to avoid penalty.

#1 – IRS Tax Refund Scams

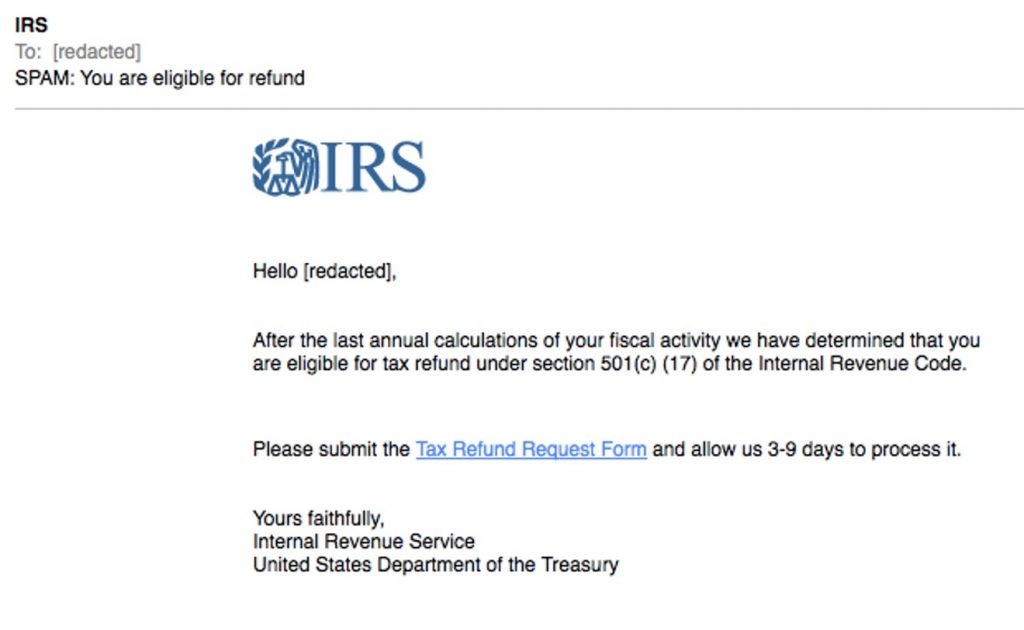

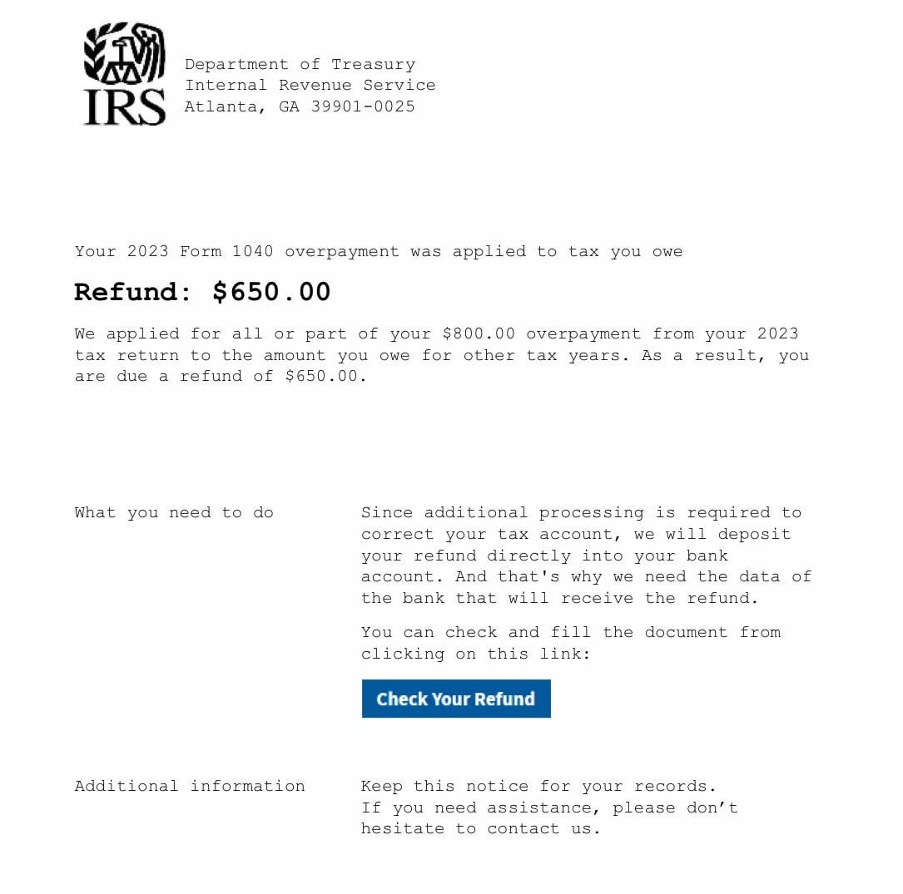

During every tax season, there are always lots of fake IRS emails. One of the most common scam tactics is offering a fake tax refund. Scammers claim that you’re eligible for a tax refund and instruct you to apply for it using the link they provide.

Don’t click! These links will lead you to a fake IRS website where you could reveal your personal information, including your ITIN. Once again, be careful!

#2 – Economic Impact Payments Scams

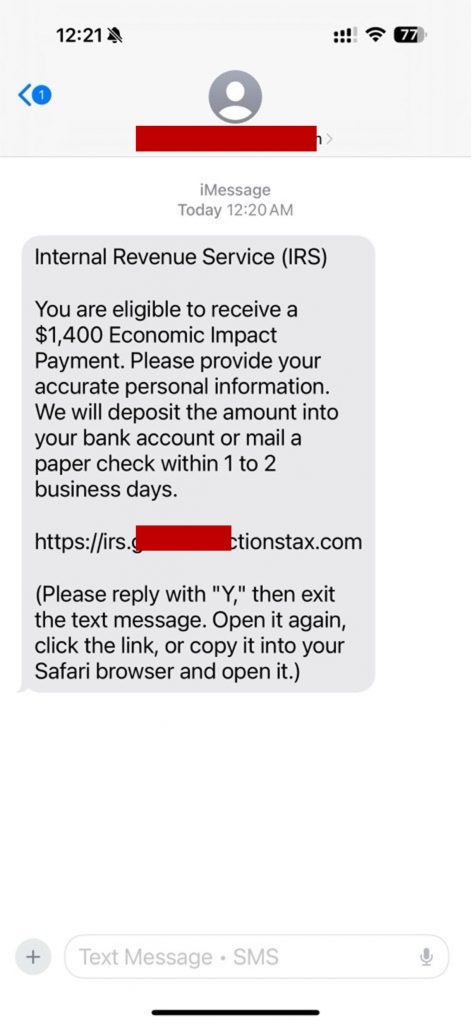

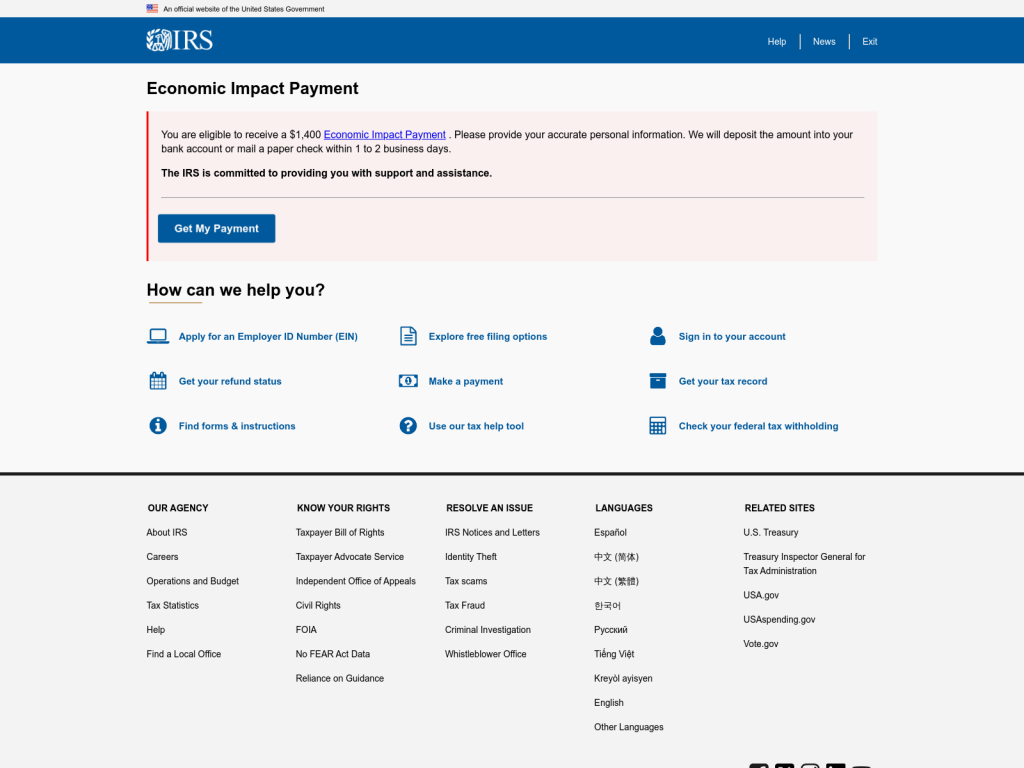

While citizen hope for the stimulus payments, scammers are spreading scam text messages impersonating the IRS. Posing as IRS, scammers say that you are eligible for the $1,400 Economic Impact Payment and instruct you to claim it by providing personal information via the attached link:

Once again, the link will lead to bogus IRS websites that are designed to steal all the personal information you’ve entered.

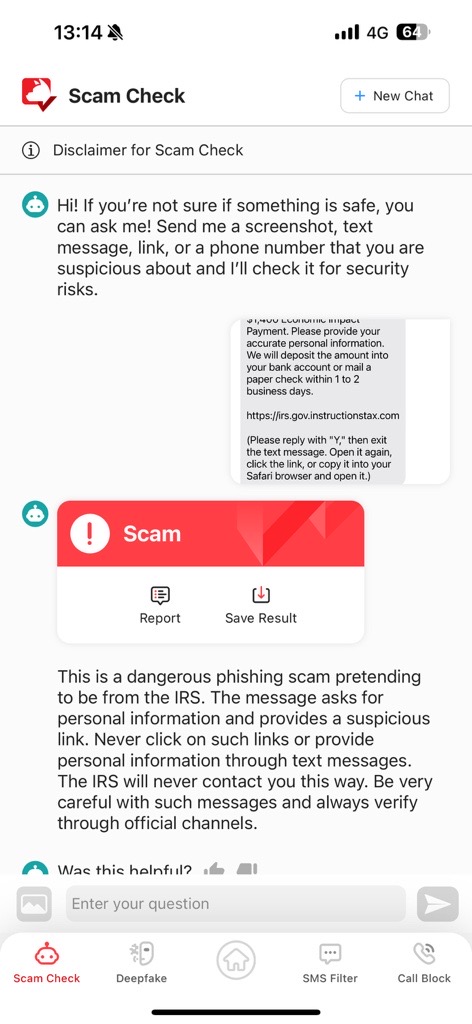

Note: When you are not sure if something you receive is a scam, verify its legitimacy before you take any action. Try Trend Micro ScamCheck!

Copy-paste the content of a suspicious text or simply share a screenshot of it with Trend Micro ScamCheck for instant answers about whether it’s a scam or not. Here’s what ScamCheck thinks of the IRS Economic Impact Payment text:

Our AI-powered Scam Check feature goes beyond spotting common red flags and scam URLs; it dives deeper into the content to uncover those tricky, less obvious signs of scams. Click the button below to give it a try!

#3 – IRS “Offer in Compromise” Scam

Many people turn to the IRS’s “Offer in Compromise” (OIC) program to reduce taxes. Beware! Scammers have created fake OIC programs/websites to trick people into parting with their money (by charging fees) or sharing their PII.

- Eliminate all tax debt with this secret the IRS does not want you to know about http:// noortimer[.]com.

#4 – Fake Tax Assitance Program

Scammers also make up fake tax assistance programs and trick you into joining to help reduce your taxes. However, the scammers’ goal is to prompt you to click on the embedded button and take you to other scam websites; no matter where they take you, you won’t be able to deduct a cent of your taxes. What’s worse, you could even get scammed out of extra money or PII on these scam sites. Don’t let that happen!

Note: the IRS won’t initiate contact with you by email, text, or social media! You can visit the IRS official website to check if you qualify for the program.

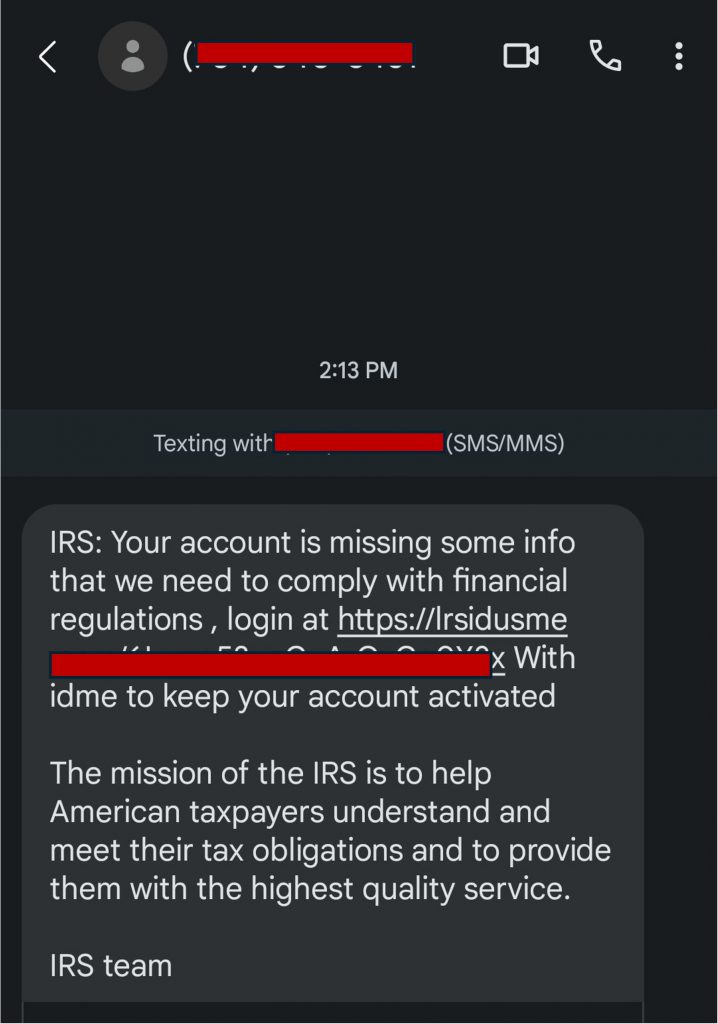

#5 – Fake Issues with IRS Account

In some cases, scammers just falsely claim that there are issues with your IRS account and ask you to visit the attached link to fulfill the details of your personal information. And yes, again, the link will take you to a fake IRS website where scammers can record all the credentials you’ve submitted. Don’t let them!

Note: Always go to the official IRS website to find the genuine login page for your IRS online account.

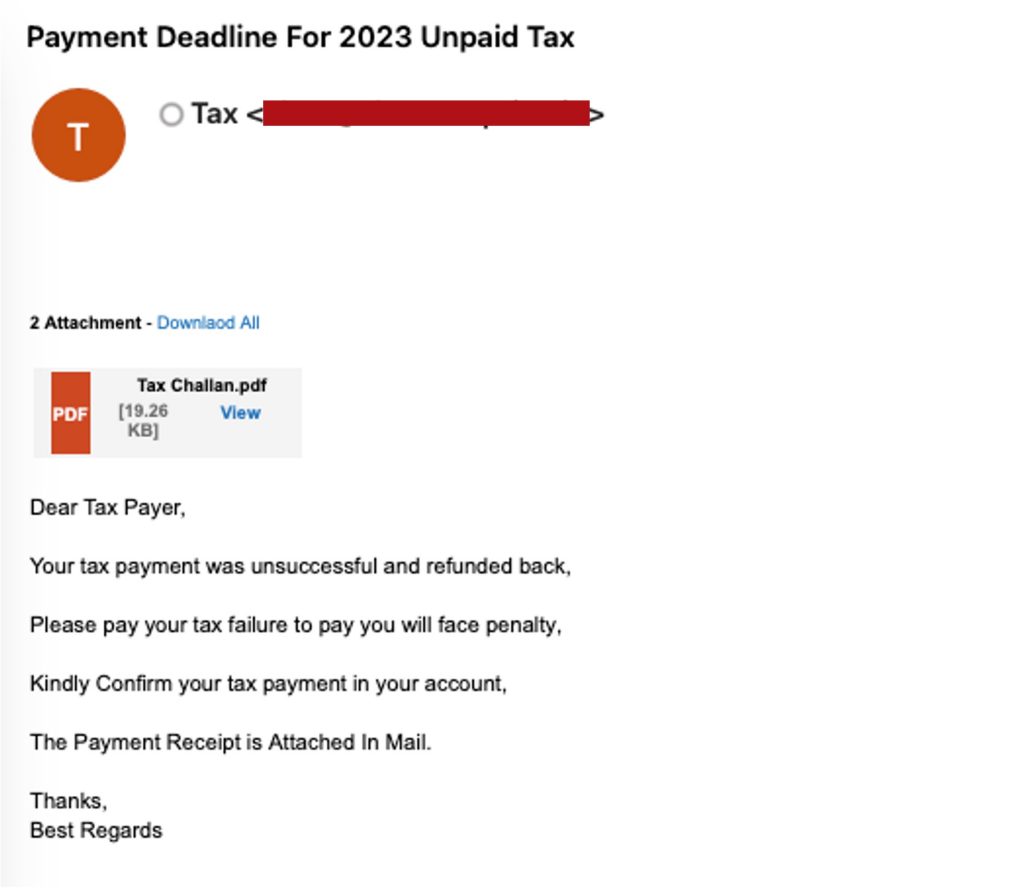

#6 – Fake Unpaid Taxes Notification

Scammers also try to convince you that you still owe them taxes for previous years. In the fake email, they attach a file for you to review, but it is malicious. Don’t click!

More IRS Tax Scams Safety Tips

- Double-check the sender’s mobile number/email address.

- Don’t click on links or attachments from unknown sources.

- Always contact the IRS officials directly for help.

- Protect your tax filing with an Identity Protection PIN (IP PIN).

- Don’t reveal your login credentials and other personal information to others.

- Report suspicious emails to phishing@irs.gov if you suspect a tax scam.

For more tax season safety tips, please visit this article.

ScamCheck: your all-in-one defense against scams

Available for both Android and iOS, ScamCheck offers comprehensive protection from deceptive phishing scams, scam and spam text messages, deepfakes, and more:

- Scam Check: Instantly analyze emails, texts, URLs, screenshots, and phone numbers with our AI-powered scam detection technology. Stay secure and scam-free.

- SMS Filter & Call Block: Say goodbye to unwanted spam and scam calls and messages. Minimize daily disruptions and reinforce your defenses against phishing.

- Deepfake Scan: Detect deepfakes in real-time during video calls, alerting you if anyone is using AI face-swapping technology to alter their appearance.

- Web Guard: Surf the web safely, protected from malicious websites and annoying ads.

To download Trend Micro ScamCheck or to learn more, click the button below.

Stay safe this tax season! If you’ve found this article an interesting and/or helpful read, please SHARE it with friends and family to help keep the online community secure and protected. Also, please consider leaving a comment or LIKE below.