What is PII?

Personally identifiable information (PII) is any data that can be used to identify you, like your name and address, Social Security number, or bank account number. With technology becoming more prevalent in our lives, it’s now easier than ever for PII to be stolen and misused. That’s why it’s crucial to know the risks of sharing your personal information and how to keep it safe.

Here are some common examples of PII:

- Full name

- Home address

- Email address

- Social Security number

- Passport number

- Driver’s license number

- Credit card number

- Bank account number

- Date of birth

- Place of birth

- Mother’s maiden name

- Biometric data (e.g. fingerprints, retina scans)

- IP address

- MAC address

Why does PII matter?

PII is important to keep safe because it can be used by identity thieves to commit fraud or other criminal activities. For example, if someone gains access to your PII, they can use it to open accounts in your name, take out loans, or even file fraudulent tax returns. This can result in serious financial harm, damage to your credit score, and damage to your reputation.

How identity thieves can use your PII?

Identity thieves can use your PII in many different ways, such as:

Opening new credit card accounts

By using your Social Security number and other personal information, an identity thief can open new credit card accounts in your name without your knowledge.

Applying for loans

Identity thieves can also use your PII to apply for loans, like car loans or personal loans, which could harm your credit score and financial well-being.

Filing fraudulent tax returns

An identity thief can file a fake tax return in your name, claiming a refund and causing you trouble with the IRS.

Renting an apartment

With your PII, an identity thief can rent an apartment in your name, leaving you responsible for damages or unpaid rent.

Obtaining medical services

An identity thief can use your insurance information to receive medical services, leaving you with the bills and a damaged credit score.

Obtaining government benefits

An identity thief can use your PII to apply for government benefits, such as unemployment or Social Security benefits, which could cause problems when you need to access these benefits.

Committing crimes in your name

Identity thieves can use your PII to commit crimes, leaving you responsible for their actions and possibly causing you legal trouble.

How to keep your PII safe

Protecting your PII is crucial to prevent identity theft and other fraudulent activities. Here are some practical steps you can take to safeguard your PII:

Utilize robust passwords and update them frequently

Creating strong passwords that include a mix of uppercase and lowercase letters, numbers, and symbols can make it harder for hackers to guess them. To enhance your security, refrain from using identical passwords for multiple accounts and make sure to update them regularly.

Be cautious about sharing PII

Only share your personal information with trusted sources, whether online or in person. Be wary of any unsolicited requests for your PII, such as emails or phone calls from unknown sources. Additionally, watch out for scammers posing as legitimate businesses or government agencies to try to trick you into sharing your information.

Exercise caution about what you share on social media

Refrain from sharing sensitive personal information such as your address, phone number, or financial information on social media platforms.

Monitor your credit report regularly

Check your credit report regularly for any suspicious activity that could be an indication of identity theft or fraudulent activities.

Use two-factor authentication

Enable two-factor authentication for your online accounts that offer this feature. This adds an extra layer of security to your accounts, making it harder for hackers to gain unauthorized access.

Avoid clicking on links in suspicious emails

Be cautious when opening emails from unknown sources or those that seem suspicious. Do not click on any links or download attachments from these sources as they may contain malware that can steal your PII.

Use a VPN when connected to public Wi-Fi networks

When using public Wi-Fi, always use a virtual private network (VPN) to encrypt your internet connection. This makes it more difficult for hackers to intercept your data and steal your PII.

Regularly monitor your financial statements

Review your bank and credit card statements regularly to check for any suspicious activity. If you notice anything unusual, report it to your financial institution immediately.

Report any suspicious activity

If you suspect that your personal information has been compromised, report it to the appropriate authorities, such as your bank, credit card company, or the Federal Trade Commission (FTC).

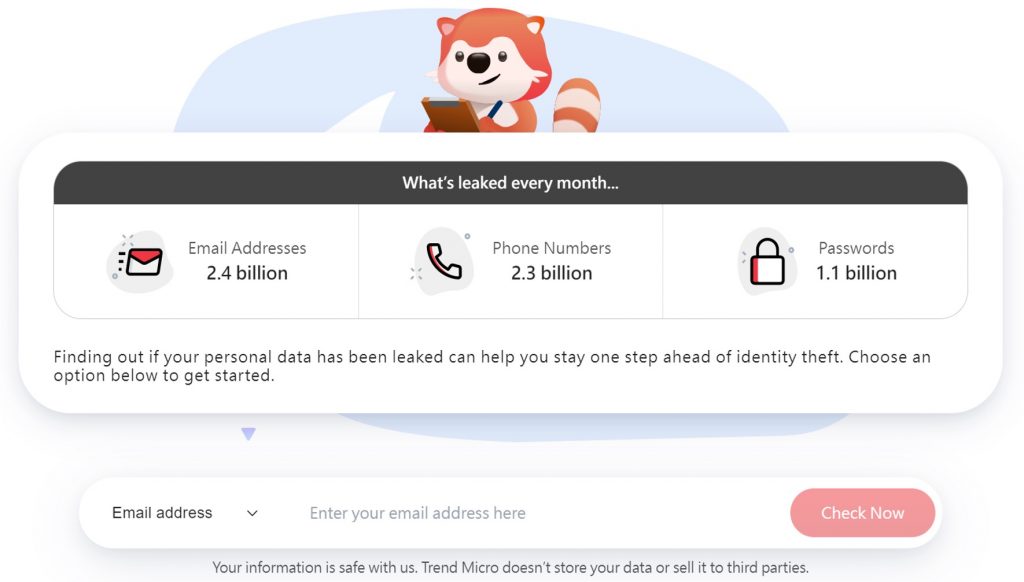

Protecting Your Identity and Personal Info

With our new (and FREE!) Identity Protection tool, you can:

- Check to see if your data (email address, phone number, password, social media) has been exposed in a leak.

- Secure your social media accounts with our Social Media Account Monitoring tool, with which you’ll receive a personal report.

- Receive the strongest tough-to-hack password suggestions from our advanced AI.

Additionally, it doesn’t hurt to have reliable cybersecurity protection, too!

If you’ve found this article an interesting and/or helpful read, please SHARE it with friends and family to help keep the online community secure and protected. Also, please consider clicking the LIKE button below.