Last Updated on June 13, 2023

Zelle, the well-known digital payment app, is mega-popular because of its convenience. However, scammers also find Zelle convenient to use as a tool for cheating people out of money! Keep reading to check out 2 of the most common Zelle scams and learn how to protect yourself:

Zelle Scams Targeting Facebook Marketplace Sellers

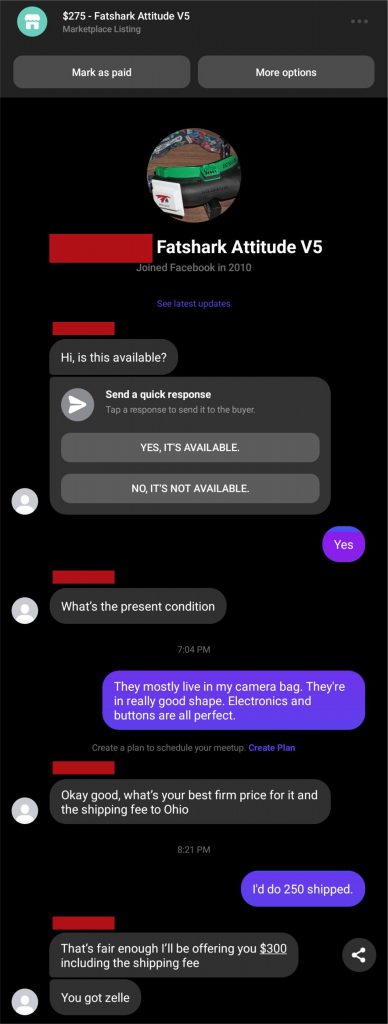

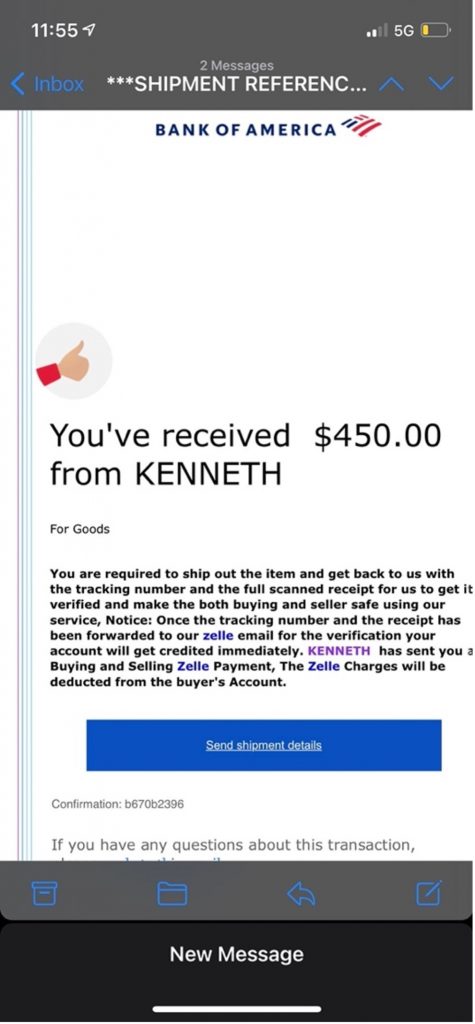

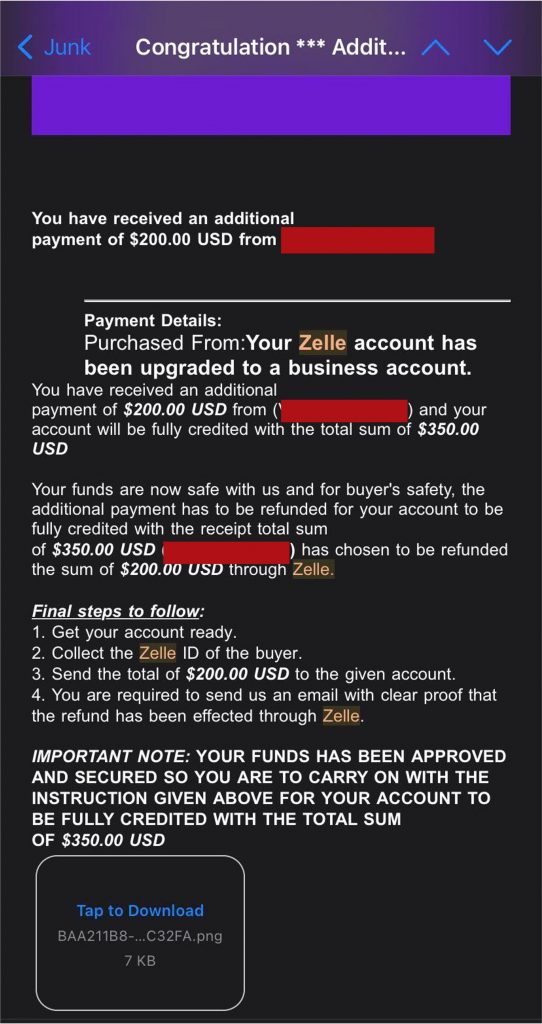

Scammers have also been targeting online sellers. If you’re selling something on Facebook Marketplace, they may impersonate potential buyers and contact you saying they wish to purchase it. Then will insist on using Zelle to pay you, and they may even offer to pay more than the asking price.

Then they will send you a fake Zelle payment notification, making you believe that they’ve paid for the item. You may also receive a fake email from your bank, falsely claiming that they have already paid with Zelle, making you believe you need to send them the item. Of course, they haven’t sent you a cent!

In other instances, they complain that there were issues with their payment and ask you to give them a refund. If you fall for the lie and send them the money, you’ll never get it back!

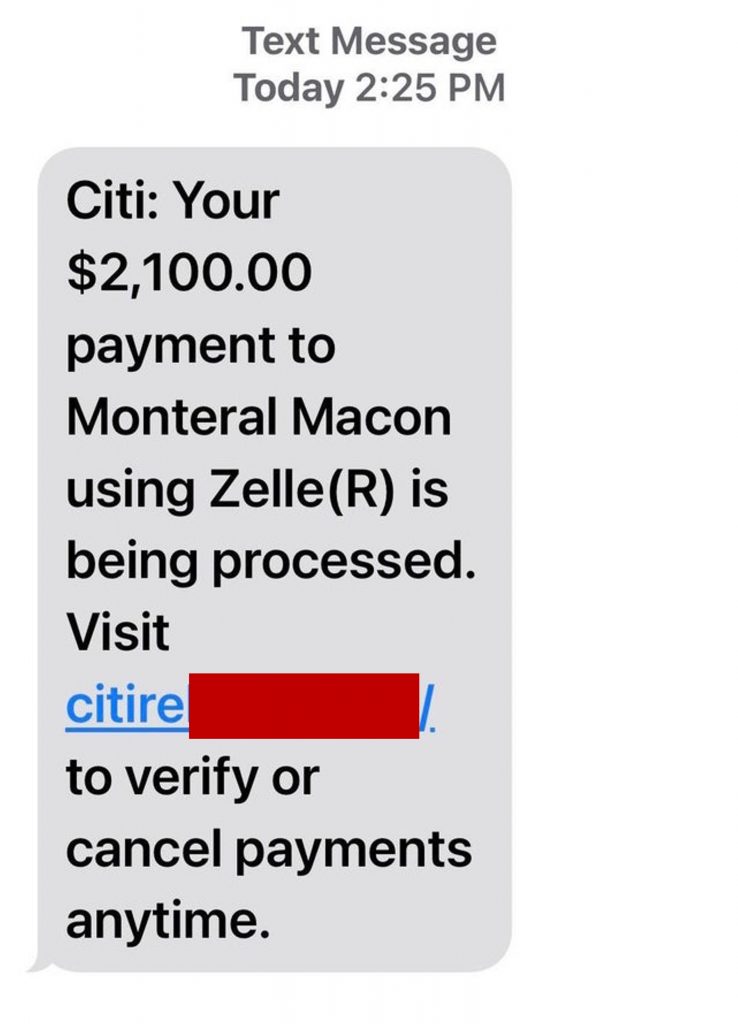

Zelle Scams Targeting Bank Customers (Bank of America/Wells Fargo/Citibank…)

Step #1 — A fake text message or email from a bank

Scammers impersonate banks such as the Bank of America or Wells Fargo and send you a fake “security alert” that says you’ve approved a Zelle payment. You’re instructed to reply to the message or phone the provided number if you don’t recognize the payment — which you obviously won’t because it’s fake! Sometimes the scammers will call you directly, too.

Step #2 — A phone call with a fake bank employee

On the phone call (the caller ID will be spoofed as the bank’s name), a scammer will pose as a bank employee and inform you that the email you received means your bank account has been compromised. To stop you from losing all your money, the fake employee will urge you to use Zelle to transfer all your money to your own personal Zelle account.

Step #3 — Losing all your money

The scammers then guide you step-by-step into making a Zelle transaction — to a Zelle account you’re lead to believe is your own. However, although the Zelle account is in your name, it is actually controlled by the scammers and any money sent to this account will go straight into their pockets.

The above examples are how Zelle payment scams or Zelle email scams work. Just be careful!

How to Protect Yourself from Zelle Payment Scams & Zelle Scam Emails

- Double-check the sender’s mobile number/email address. Take note of caller ID, but be aware that it can be spoofed!

- Be extra wary if a potential buyer insists on using Zelle or another online payment app.

- Turn to the bank’s official website to confirm any details regarding any security alerts.

- Click here to report a fraud or scam to Zelle.

- Think twice before you make any payments through Zelle. Zelle suggests that you only use it with friends and family to better protect against scams. According to Zelle, if you “authorized” a payment, you may not be able to get your money back.

- NEVER click links or attachments from unknown sources. Use Trend Micro ScamCheck to detect scams with ease!

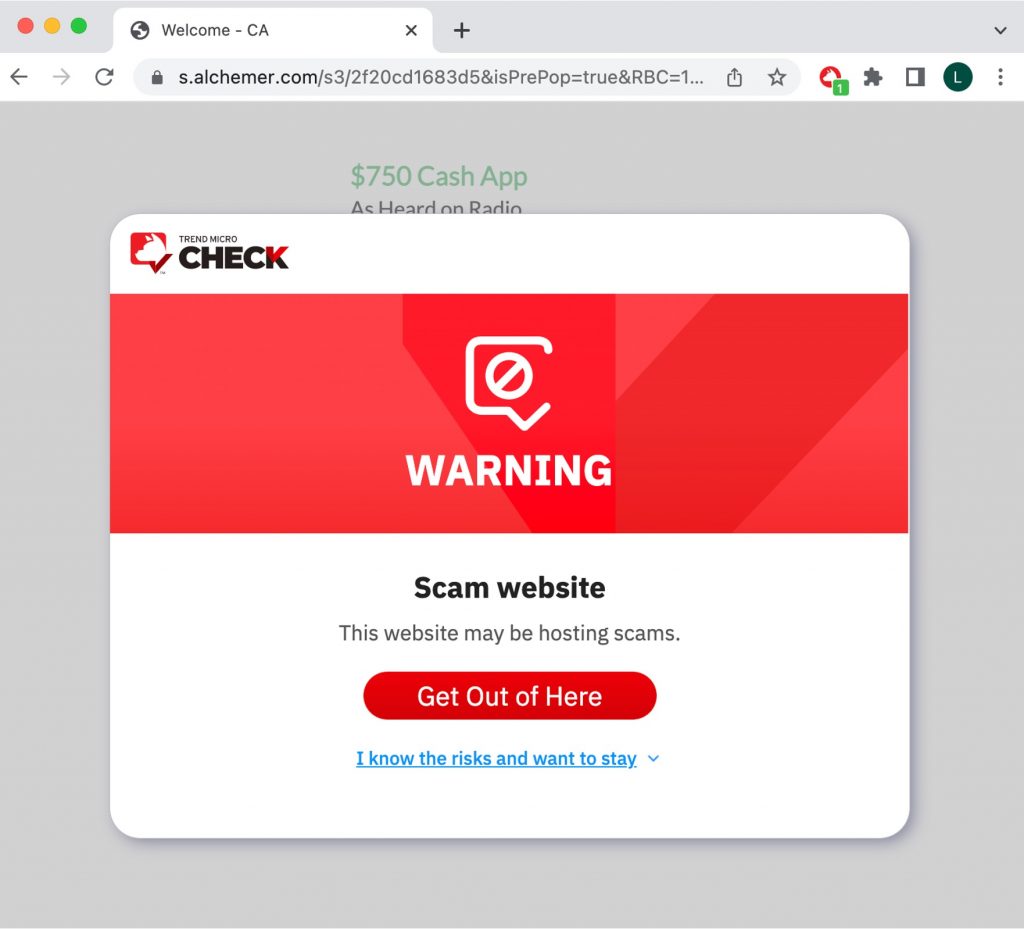

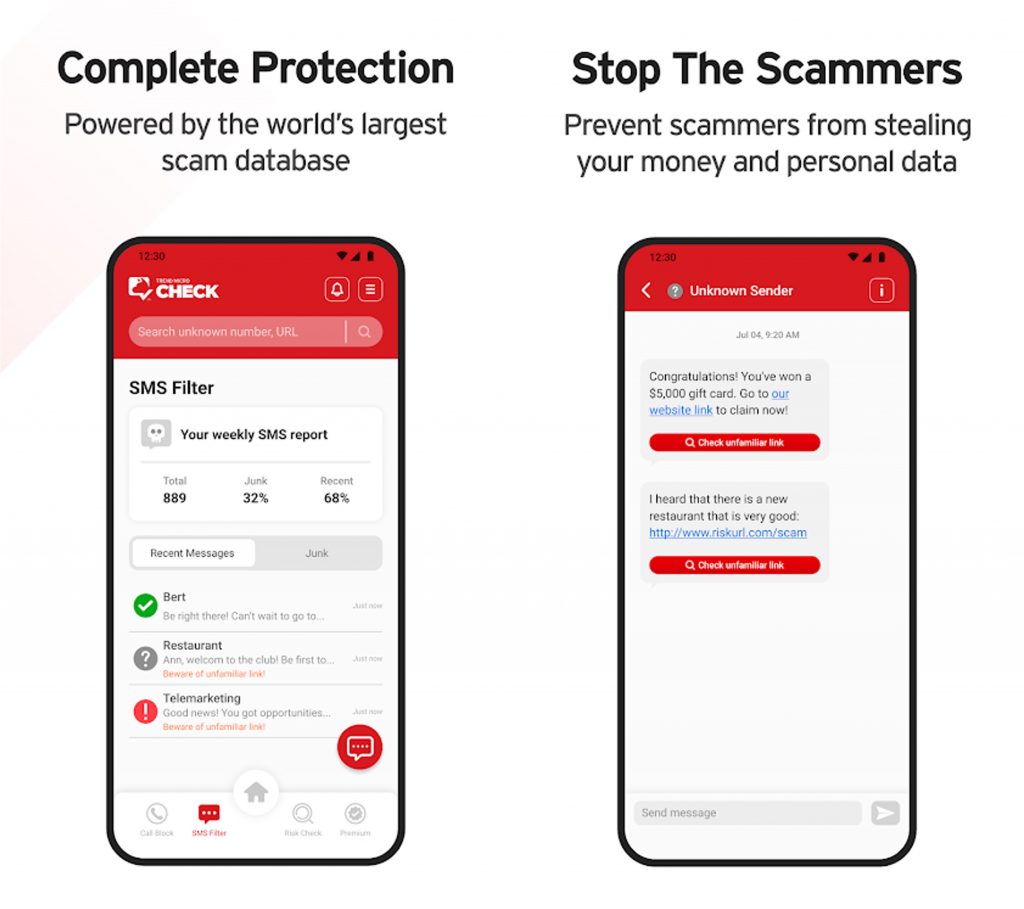

Trend Micro ScamCheck is a browser extension and mobile app for detecting scams, phishing attacks, malware, and dangerous links — and it’s FREE!

After you’ve pinned the ScamCheck extension, it will block dangerous sites automatically! (Available on Safari, Google Chrome, and Microsoft Edge).

You can also download the ScamCheck mobile app for 24/7 automatic scam and spam detection and filtering. (Available for Android and iOS).

Check out this page for more information on ScamCheck.

As ever, if you’ve found this article an interesting and/or helpful read, please do SHARE with friends and family to help keep the online community secure and protected.