“You must follow my directions very carefully. We do not have much time.” These are some of the words scammers used to influence and ultimately defraud Charlotte Cowles, a financial columnist at New York Magazine, in an elaborate imposter scam that cost Cowles and her family $50,000. In this one line alone, there are two classic tactics of social engineering schemes present: fear, and time-pressure.

“If you don’t cooperate, I cannot keep you safe. It is your choice.”

This week an article in The Cut magazine, penned by Charlotte Cowles, has gone viral — reflecting the fears we all have of falling prey to scams and identity theft. In a brave and highly detailed account, Cowles recounts her story.

In short: she is informed by a series of scammers (impersonating Amazon, the FTC, and the CIA) that she has been the victim of identity theft; that she is in serious legal trouble; that her accounts and SSN will be terminated; that she should withdraw $50,000 in cash with which to live on; and that a CIA agent will look after the money for her. The story ends with the scammers driving off with her money while the realization — and ramifications — slowly dawn on Cowles.

Cowles’s article is a powerful testimony for two reasons. Firstly, it shows how organized and convincing scammers are nowadays. Secondly, the fact this happened to someone who is professional, knowledgeable, and literally works in financial prudence, completely dismantles the myth that only the naïve and the elderly fall for scams. (Not that this should even be a surprise: see here, and here, for example.)

To her credit, Cowles even felt that something was wrong, but the power of manipulation and fear was too great — before it was too late. In her own words:

“If it was a scam, I couldn’t see the angle. It had occurred to me that the whole story might be made up or an elaborate mistake. But no one had asked me for money or told me to buy crypto; they’d only encouraged me not to share my banking information. They hadn’t asked for my personal details; they already knew them. I hadn’t been told to click on anything.”

“Or you […] put yourself and your family in danger. Do you really want to take that risk with a young child?”

Scams, and imposter scams in particular, grow exponentially year on year. The FTC reports that last year fraud losses were over $10 billion — a 14% increase on the previous year. Imposter scams alone made up $2.7 billion of that total amount. These statistics, and Cowles’s article drive home the need for cyber safety, skepticism, and the diligent following of best practices. Read on for some handy tips.

Seven Warning Signs of Identity Theft

- A tax return is filed under your name without your authorization.

- Mail is addressed to your home but to another person.

- Debt collectors get in touch regarding accounts you don’t recognize.

- Your information was leaked in a data breach.

- You are billed for medical services you never used.

- You spot a new account in your name that you didn’t open.

- The IRS get in touch to inform you that you’re Social Security card is being used fraudulently.

How to Check if Someone Is Using Your Identity

Be sure to follow these three best practices to stay ahead of identity thieves:

- Stay on top of bills: Know what you owe and when it’s due. If you stop receiving a bill, and it wasn’t you that made this change, this could be a red flag that someone has changed your billing address. Similarly, if you receive new bills, which you didn’t sign up for, an identity thieve may be using your personally identifiable information (PII).

- Bank statements: You should regularly review your bank account statements. If you see a transaction that you don’t recognize, it could be a sign that your identity has been stolen.

- Credit report: You should also check your credit regularly. To do so you’ll need to request a report from the three credit-reporting bureaus (Equifax, Experian, and TransUnion). Your credit score isn’t enough to ascertain if you’re identity has been stolen; you’ll need the full report to check for unknown accounts and transactions, and to look for any false information. For a guide on how to do this, head over here!

Further top tips:

- Check your health insurance records and tax return information

- Make sure you always have access to sensitive online accounts

- Watch out for spam emails, texts, and mail

- Check for physical mail and stolen trash

- Always know where your ID, credit cards, and other sensitive documents are kept

- Check your “mySocial Security” account for signs of fraud

Even if you follow these guidelines, scammers may still come knocking. ALWAYS be skeptical, and do NOT accept facts from one person over a phone. When in doubt, ALWAYS contact a company or organization directly — and remember, no government body will ask for money in the way the scammers did to Cowles.

Protecting Your Identity and Personal Info

Compromised personal data can have serious consequences, including identity theft, financial fraud, and job losses. The best thing you can do is a) have reliable cybersecurity protection, and b) ensure you will find out ASAP in the event of being affected. We would encourage readers to head over to our new ID Protection platform, which has been designed to meet these challenges.

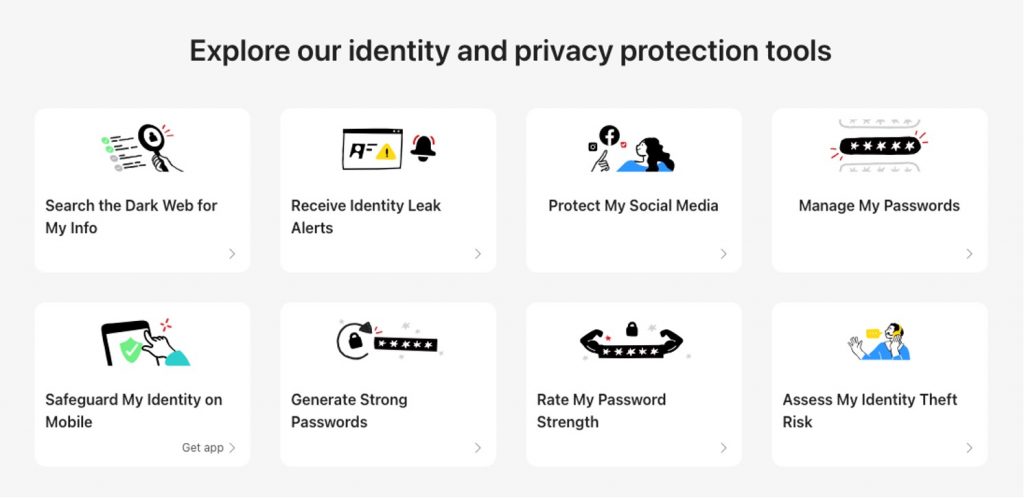

With ID Protection, you can:

- Check to see if your data (email, number, password, credit card) has been exposed in a leak, or is up for grabs on the dark web;

- Secure your social media accounts with our Social Media Account Monitoring tool, with which you’ll receive a personalized report;

- Create the strongest tough-to-hack password suggestions from our advanced AI (they’ll be safely stored in your Vault);

- Enjoy a safer browsing experience, as Trend Micro checks websites and prevents trackers.

- Receive comprehensive remediation and insurance services, with 24/7 support.

Offering both FREE and paid services, ID Protection will ensure you have the best safeguards in place, with 24/7 support available to you through one of the world’s leading cybersecurity companies. Trend Micro is trusted by 8 of the top 10 Fortune 500 Companies — and we’ll have your back, too.

Why not give it a go today? As always, we hope this article has been an interesting and/or useful read. If so, please do SHARE it with family and friends to help keep the online community secure and informed — and consider leaving a like or comment below. Here’s to a secure 2024!