Few things in life are more convenient than online banking. Checking your balance, transferring money, applying for loans or credit cards, and even starting an investment portfolio — it can all be done online without the need to wait in line at the bank.

Although it’s convenient, many people have their concerns about whether it’s safe to open an online bank account, and perhaps more importantly, whether their money would be safe. Well, the short answer is yes, it is 100% safe to open a new bank account online, but for the full scoop, keep on reading.

What do you need to open a bank account online?

If you’ve never done online banking before, you might not know where to start. However, opening an online bank account and taking advantage of all the conveniences it offers is quite straightforward, but because all banks are required to confirm your identity, you should have the following to hand:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your driver’s license, passport, or other government-issued identification

- Your phone number and email address

- Your physical U.S. address

- If you’re under 18, a co-applicant who is over 18

Additionally, because banks often require you to deposit some money into your new account after it’s created, you should have the means to do that to hand too (a debit or credit card works great).

How to open a bank account online

Once you’ve got all your supporting documents/information ready, opening a bank account online is fairly hassle-free. Generally, this is how it works:

- Decide which type of account you want: Most banks will have a variety of different account types available (checking accounts, savings accounts, joint accounts, etc.). So once you’re on your chosen bank’s website, choose which one you would like to open.

- Complete your application: Once you’ve decided on your desired account type, go through the application process (normally this will be started by clicking an “Open an account” or “Start your application” button). Please note that you may have to answer a few legal questions and agree to a few legal documents/privacy policies before your application is complete.

- Wait for your application to be approved: Certain banks will immediately let you know if your application has been approved, but it’s also normal to need to wait.

- Make your first deposit: After your account is approved, you may need to deposit some money, but presumably, you’ll want to anyway. You can use a credit or debit card to do so online, or with cash or a check in person.

Is it safe to open a bank account online?

Opening and using an online bank account is perfectly safe, but there is one danger you need to be aware of: bank scams.

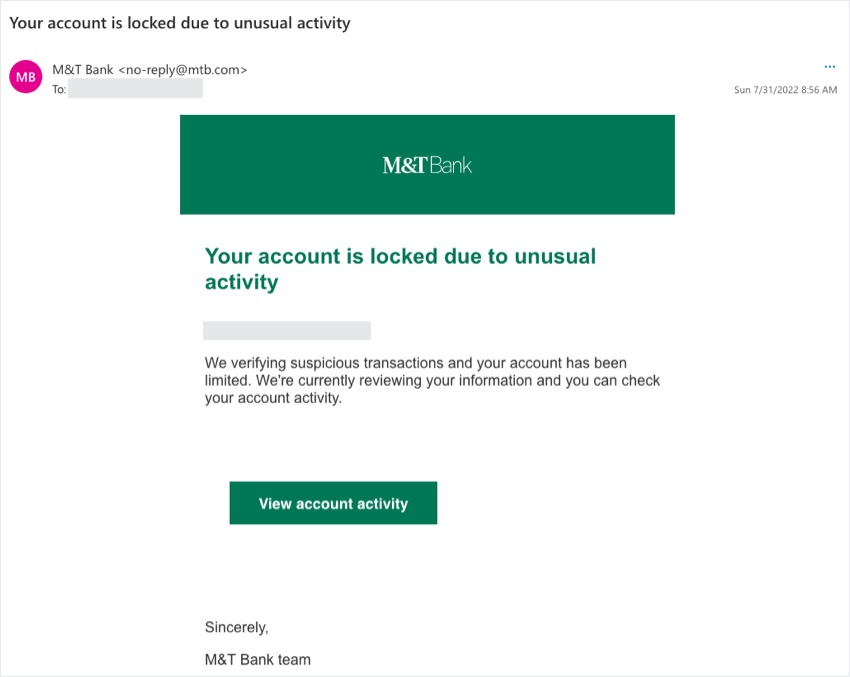

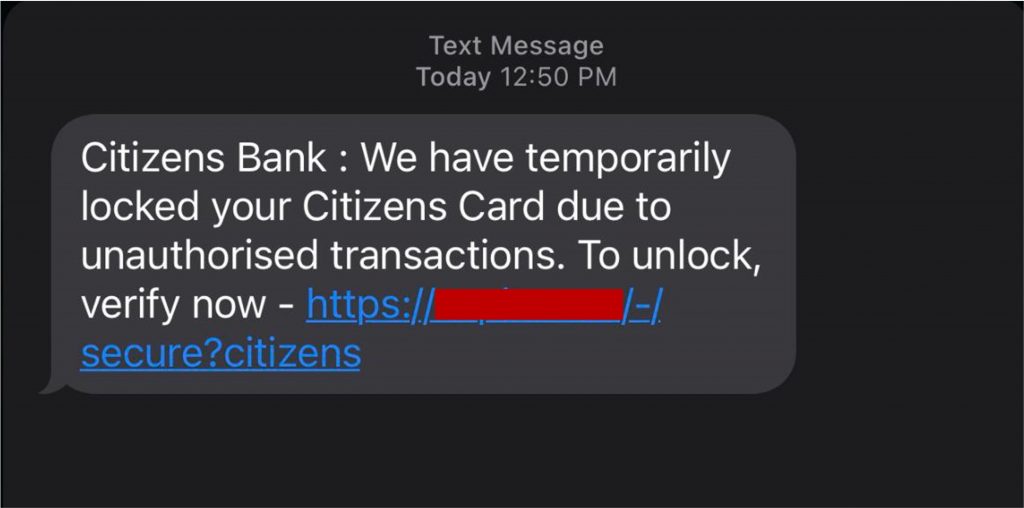

Bank scams can come in a variety of forms, but they will often be bogus emails and text messages that purport to be legitimate correspondence from your bank. They are called phishing scams and below are two examples.

Just like in the examples above, most of these phishing scams will say there is a problem with your account — perhaps it’s in danger of being closed and/or your funds lost. The scammers are hoping you will be panicked enough to click the malicious button/link in the message, and this is where the scams often get very deceptive.

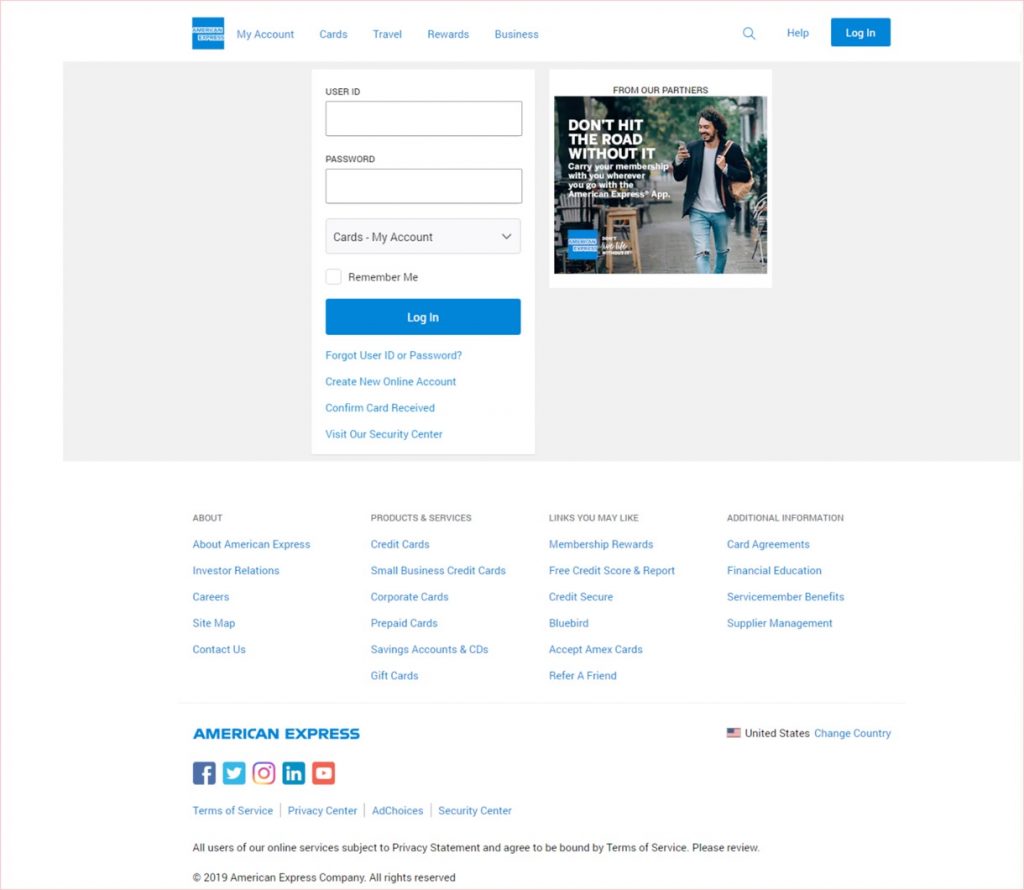

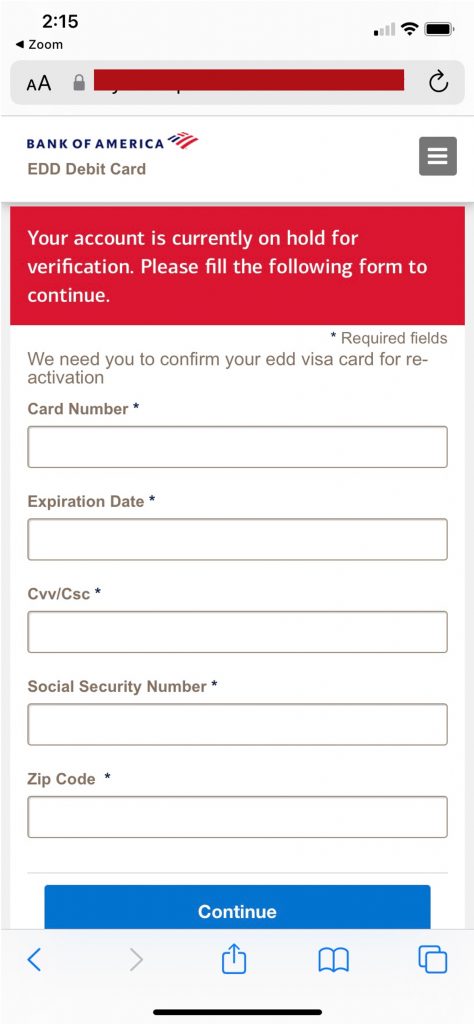

The scammers are very clever and cunning, so much so that they’re able to create highly convincing copycat versions of legitimate banking websites. See below for two examples.

The fake websites are designed to trick people into entering their personal/financial information, with which the scammers can access victims’ bank accounts, commit identity theft, profit by selling it to criminals on the dark web, and lots of other illicit activities.

Worried about a potential data breach?

Some people cite fear of their bank suffering a potential data breach as the reason they would rather not open an online bank account. However, whether you open your account online or in person, the bank will still have your personal information, so the risk is the same.

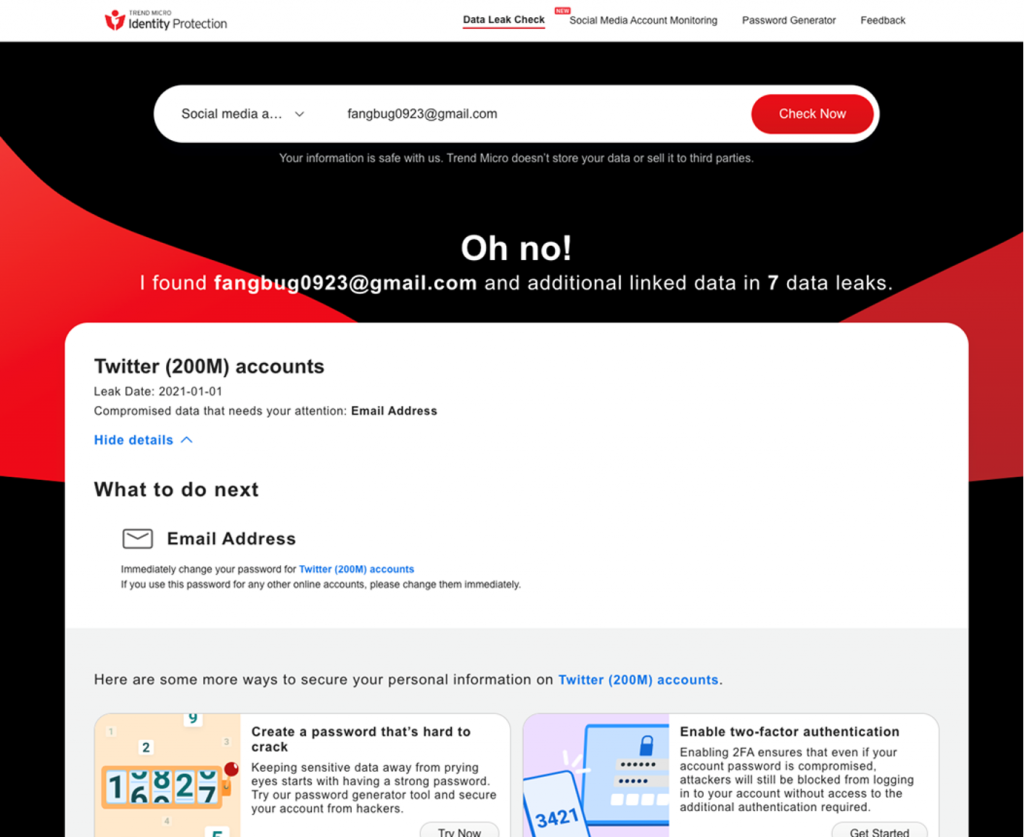

Furthermore, with Trend Micro ID Protection (which is 100% FREE), you can stay in the know regarding your data. You can use ID Protection too:

- Check to see if your data (email address, phone number, password, social media account) has been exposed in a leak.

- Secure your social media accounts with our Social Media Account Monitoring tool, with which you’ll receive a personal report.

- Receive the strongest tough-to-hack password suggestions from our advanced AI.

Wondering how to stay safe from bank scams?

Don’t let the threat of bank scams put you off from opening an online bank account because staying safe is easy and free. Well, it is with Trend Micro ScamCheck, anyway!

Trend Micro ScamCheck, our 100% FREE browser extension and mobile app, can protect you against scams, fake and malware-infected websites, dangerous emails, phishing links, and lots more!

In an online world filled with scams and scam sites that are getting increasingly more difficult to detect with common sense alone, Trend Micro ScamCheck can help you stay safe and protected. So, what are you waiting for? Download today for free!

If you’ve found this article an interesting and/or helpful read, please SHARE it with friends and family to help keep the online community secure and protected. Also, please consider clicking the LIKE button below.