Tax season is scam season! Posing as the Internal Revenue Service (IRS), scammers are making up tens of thousands of excuses to get in touch with you, in order to steal your money and personal information. Anyone can fall victim: make sure you’re able to spot these tax scams!

Popular Tax Scams 2022

These are the top tax scams to watch out for this tax season.

1. Tax Refund Scams

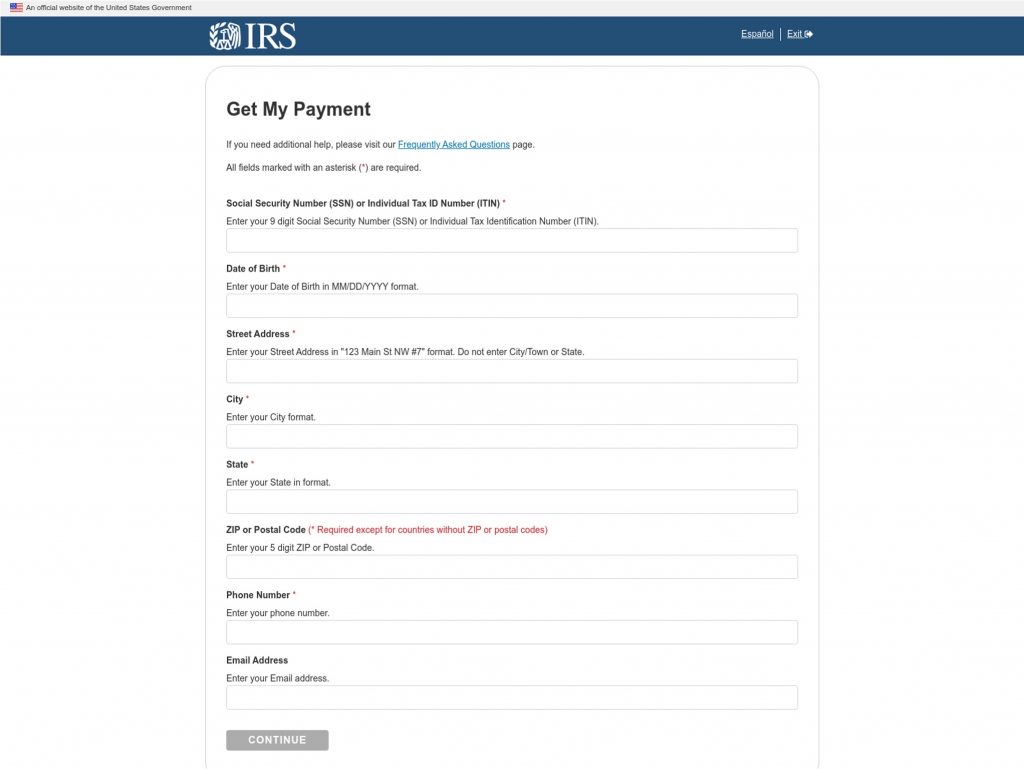

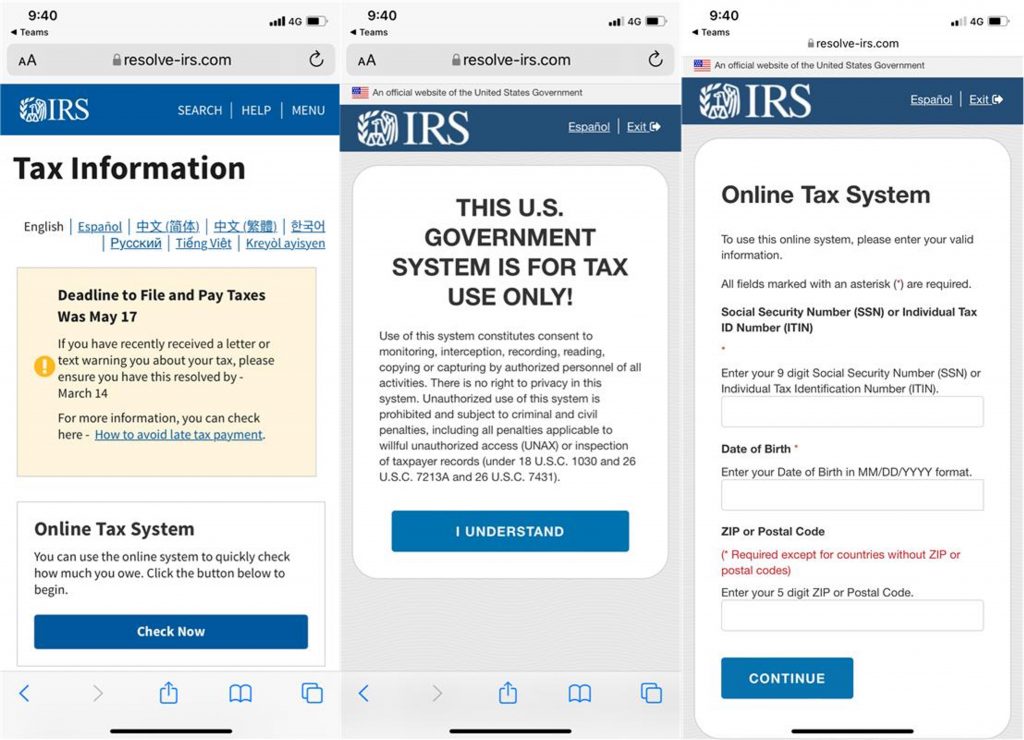

Scammers are wasting no time in launching fake tax refund websites to exploit people. They have created copycat websites that look similar to legitimate government websites. In the first 3 months of 2022, we have already detected over 135,842 bogus websites. Below is an example:

To get you on these scam websites, scammers will send you text messages or emails that instruct you to file your taxes, claim refunds, or complete other tasks via the attached links. Once you’re on these fake IRS pages, you will run the risk of exposing personal details such as your home address, date of birth, and Individual Tax ID Number (ITIN).

Example Text:

- (irs):recently, we found that you haven’t fulfilled your latest tax deductions. Visit hxxps://resolve-irs[.]com/forms to fulfill.

- IRS.TAX / MSG: You have received and amended US individual tax refund amount of $655 Submit Application & Complete Registration Form Here {URL}

- IRS.GOV – You have received and amended US #IRS_4## tax refund amount of #IRS_5##665 Submit & claim Here {URL}

- IRS.TAX – You’ve received and amended US #IRS_4## tax refund amount of #IRS_5##662 Submit application Here {URL}

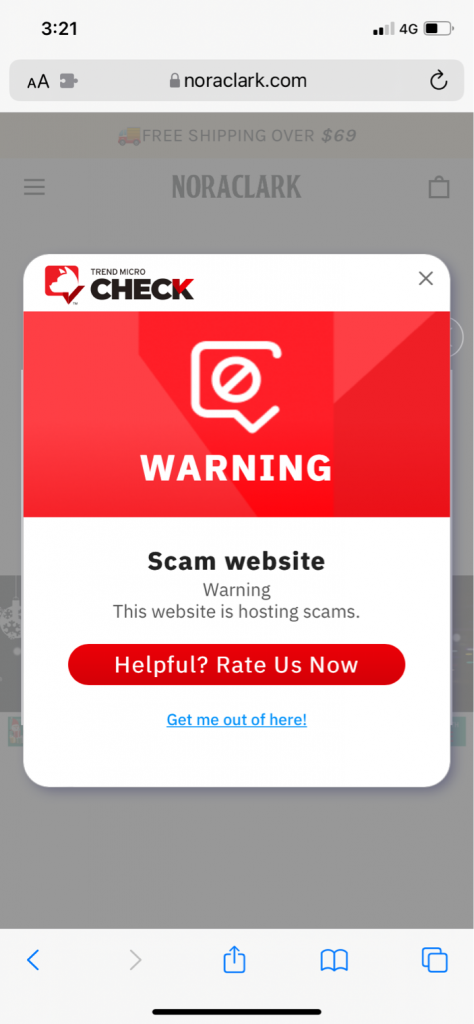

Browse the web safely with Trend Micro Check (it’s free!)

Trend Micro Check is an all-in-one browser extension for detecting scams, phishing attacks, malware, and dangerous links – and it’s FREE!

After you’ve pinned Trend Micro Check, it will block dangerous sites automatically! It’s available on Safari, Google Chrome, and Microsoft Edge.

Check out this page for more information on Trend Micro Check.

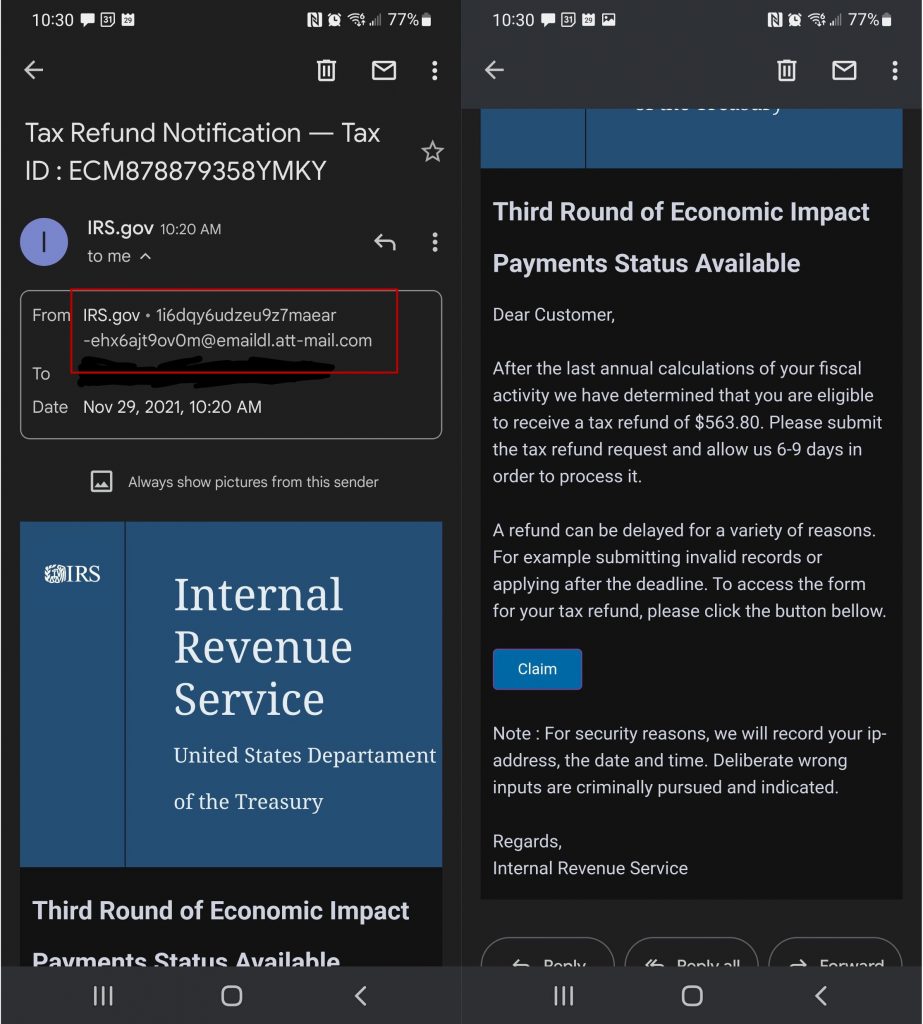

2. Stimulus Payments Scam

Recently, we’ve seen phishing attempts using the IRS Economic Impact Payments as a hook. In this scam, you’ll be told that your third round of COVID-19 Economic Impact Payments is available, prompting you to claim it via the embedded button.

If you click on the button, you will be taken to a fake IRS page and asked for personal information. Scammers will record the credentials you submit and use them for identity theft.

3. Robocall / Phone Scams: The IRS Taxpayer Advocate

Scammers pretending to be from the IRS Taxpayer Advocate Service will reach out to you through phone calls or robocalls that require you to dial back.

They will claim that there’s a problem with your tax filing. Then they ask for your credentials such as SSN, Individual Taxpayer Identification Number (ITIN), or Identity Protection PIN. With this information, they can file a bogus tax return on your behalf and deposit the so-called refund into your account.

In other instances, what they want is money — they claim that you owe taxes or that a tax refund was a mistake. They will even threaten you with penalties, and demand you pay them via gift card or wire transfer.

Tax Scams Targeting Tax Professionals

Many people choose to hire a tax expert to handle tax filing procedures, but scammers are even targeting tax professionals.

Impersonating tax software providers, scammers send fake emails to tax preparers and falsely claim that they must update their Tax Pro account to continue accessing the tax filing system. The link in these emails will lead to phishing websites that collect tax professionals’ log-in credentials.

Red Flags to Spot an IRS Tax Scam

Always bear in mind that the IRS will NEVER:

- Call you without having first notified you by mail.

- Ask you to provide information such as Identity Protection PIN.

- Demand payment using a specific payment method such as a prepaid card, gift card, or wire transfer.

- Stop you from questioning or appealing the amount they say you owe.

- Avoid showing their pocket commission and HSPD-12 card.

- Threaten to bring in law-enforcement to have you arrested for not paying.

Tips to Protect Yourself from Tax Scams

- Double-check the sender’s contact details. Hang up if you receive unexpected phone calls from the “IRS”.

- Protect your tax filing with Identity Protection PIN (IP PIN) and never reveal your log-in credentials.

- Choose professional tax preparers with an IRS Preparer Tax Identification Number (PTIN). Check credentials on the IRS web page here.

- Check your tax details via the IRS website, or the number printed on the IRS billing notice (800-829-1040).

- Use Trend Micro Check to avoid fake IRS websites and phishing links.

- Install anti-malware to block phishing emails/websites and prevent malware downloads. Maximum Security and Trend Micro Mobile Security protect your devices against malicious apps, ransomware, unsafe WiFi networks, and dangerous websites.

What If I Fall Victim to a Tax Scam?

The IRS recommends that those who think their credentials have been compromised take the following steps:

- Individuals should respond immediately to any IRS notice. Call the number provided.

- Taxpayers should complete IRS Form 14039 (Identity Theft Affidavit PDF) in the event of a tax scam or if they are instructed to do so by the IRS. Individuals can find the form at IRS.gov, then print and attach it to their paper return, according to instructions.

- Victims of tax-related identity theft should continue to pay their taxes and file their tax return, even if they must do so by paper.

- Taxpayers who have contacted the IRS about tax-related identity theft but have not found a resolution should call for specialized assistance at 800-908-4490.

Where Can I Report a Potential Tax Scam?

- If you suspect you’ve come across a tax scam like an unsolicited email impersonating the IRS, please report it to phishing@irs.gov.

- You can also report it to the Federal Trade Commission.

- For tax professionals, they can report it to the Treasury Inspector General for Tax Administration.

Stay safe out there, folks! Follow these guidelines and you’ll be well-prepared in the event of tax scam attempts. As ever, if you’ve found this article an interesting and/or helpful read, please do SHARE with friends and family to help keep the online community secure and protected.