We look for investments to improve our lives, but scammers are just interested in taking our money and personal information to improve their wallets. Have you ever been offered an investment that seemed a little too good to be true? In this article, we’ve gathered some of the most common investment scams, and how you can avoid them.

3 Facts about Investment Scams

- According to a paper from the Pension Research Council, one in ten investors will be a victim of an investment scam, Wharton School of Business.

- According to the Federal Trade Commission (FTC), the average loss per investment scam is over $16,000 per victim.

- People aged 50-69 are more likely to lose money in investment scams than other age groups, and they also have the largest losses, with a median loss of $24,000 per victim. (FTC)

Question Any Investment That:

- Promises low-risk or risk-free opportunities with high returns.

- Requires you to download apps or register on unfamiliar websites. Use Trend Micro ScamCheck to check any links for safety.

- Is “secret” or “limited” and isn’t available to the general public yet.

- Has a lot of confusing, complicated, or sophisticated terms.

- Is being offered by unlicensed brokers.

- Doesn’t have a clear method for cashing out.

Common Investment Scams

People fall for investment scams because they are presented as once-in-a-lifetime opportunities – simply too good to pass up. Sometimes, victims receive a small amount of money that “proves” the investment is legitimate. However, what the victims don’t realize is that scammers have a plan to take every penny of it back. Here are some common types of investment scams to look out for:

Fake Investment Websites

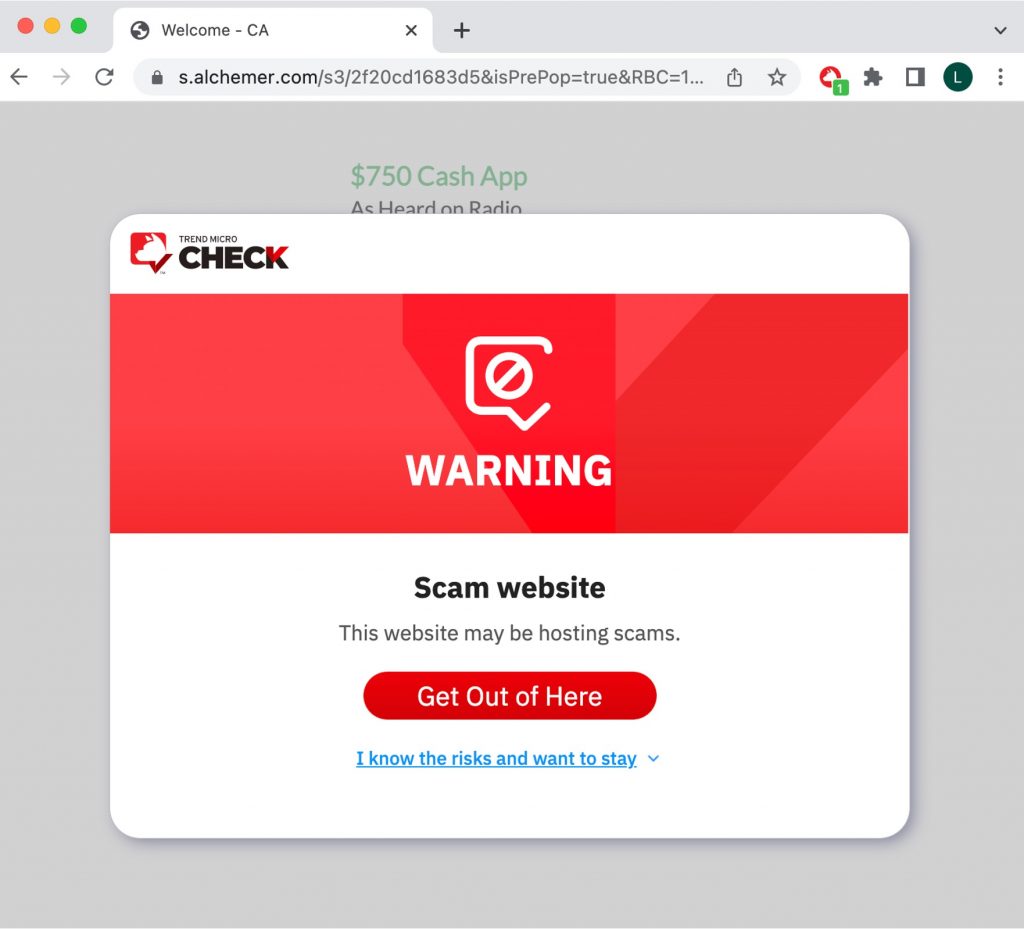

Scammers use fake websites and phishing links to trick you into giving them your personal information. To detect scams in an easy way, you can try ScamCheck – an 100% FREE, all-in-one tool to detect scams!

After you’ve pinned the ScamCheck extension, it will block dangerous sites automatically! (Available on Safari, Google Chrome, and Microsoft Edge).

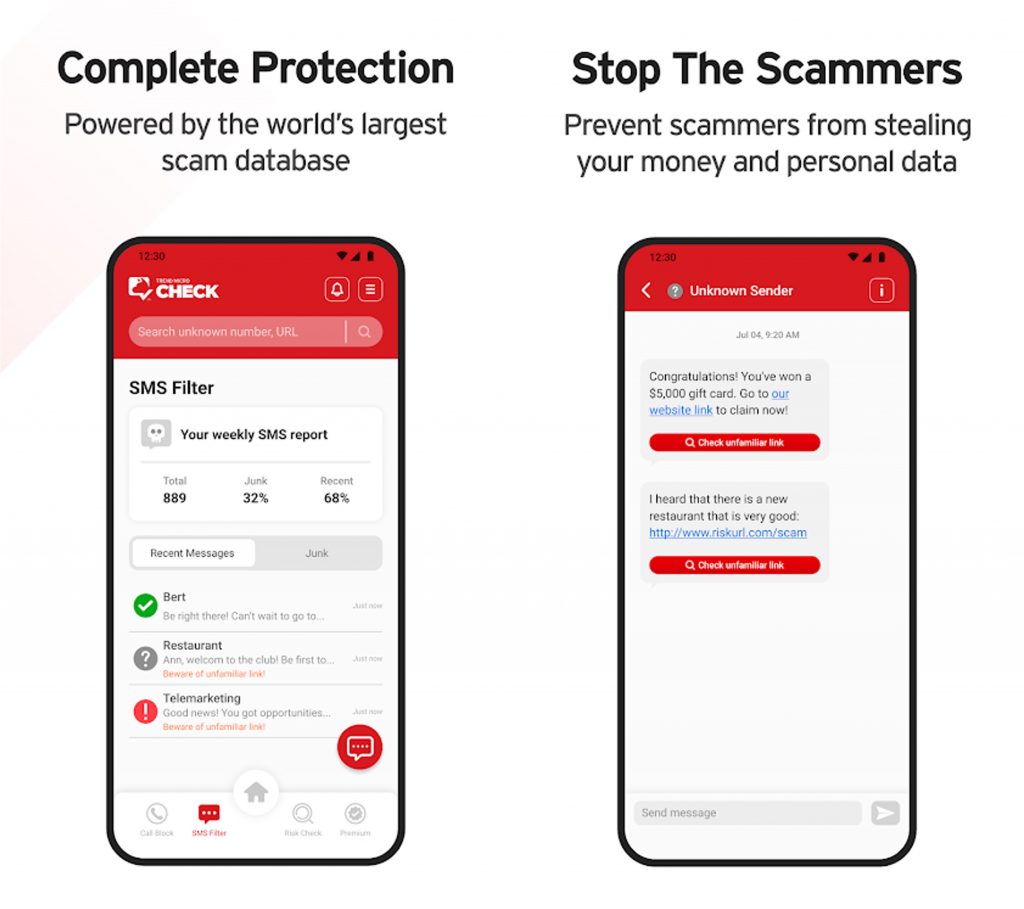

You can also download the ScamCheck mobile app for 24/7 automatic scam and spam detection and filtering. (Available for Android and iOS).

Click on the button below to try Trend Micro ScamCheck for free now:

Advance-fee Scam

Scammers ask for an upfront fee, commission, or other expense before you can participate in the investment. They claim that the money is necessary to “guarantee your place” or that it will be “paid back later.” Once scammers have your money, they will disappear with the cash, and you will be left with nothing.

Ponzi and Pyramid Schemes

Ponzi and pyramid schemes work in similar ways. In both schemes, the older investors are paid by the new investors. The difference is that the investors in a pyramid scheme know that their money comes from new investors, while Ponzi scheme victims do not.

Both schemes require a flow of new investors to keep going. If the new investments stop, so do the payouts, and the scheme will collapse.

Pump and Dump

Scammers “pump” the stock price up, then “dump” their stocks to make a profit. The stock price goes up when false or misleading information is released to the public. Once the stock price is artificially high, the scammers sell their shares, and the stock price falls. Everyone who bought the stocks at the elevated prices loses, and the scammers win.

Sometimes investment scams are combined with romance scams. Read more about romance scams: Common Romance Scams: Pig Butchering (Sha Zhu Pan), Fake Investment, Sextortion, … and MORE!

Other Investments That Scammers Exploit

Do your homework if you’re offered an opportunity in:

- Promissory notes

- Binary options

- Cryptocurrency

- Pre-IPO stocks

- Foreign currency (forex)

- Precious metals

- Commodities

Tips to Avoid Investment Scams

- Ask questions. The Securities and Exchange Commission (SEC) has a list of questions that prospective investors should ask before handing over their money.

- Do your homework. Never invest unless you fully understand the investment. Check if your broker/adviser is registered on FINRA’s Broker Check website or at the SEC Investment Adviser Public Disclosure website.

- Risk-free or 100% guaranteed returns should be a major red flag. Opportunities that are too good to be true probably aren’t real.

- Check the safety of web addresses using Trend Micro ScamCheck.

You can also help others stay away from investment scams by reporting investment scam cases to the SEC. If you have questions about investment scams, find out more from the SEC’s Office of Investor Education and Advocacy (OIEA), or email Help@SEC.gov.

If this article’s been of use and/or interest to you, please do SHARE with friends and family and help keep the online community informed and protected!